Payment Declines in ecommerce – the $340 Billion Black Hole

1 in every 10 eCommerce dollars is declined during payment authorization. How can merchants recoup that revenue?

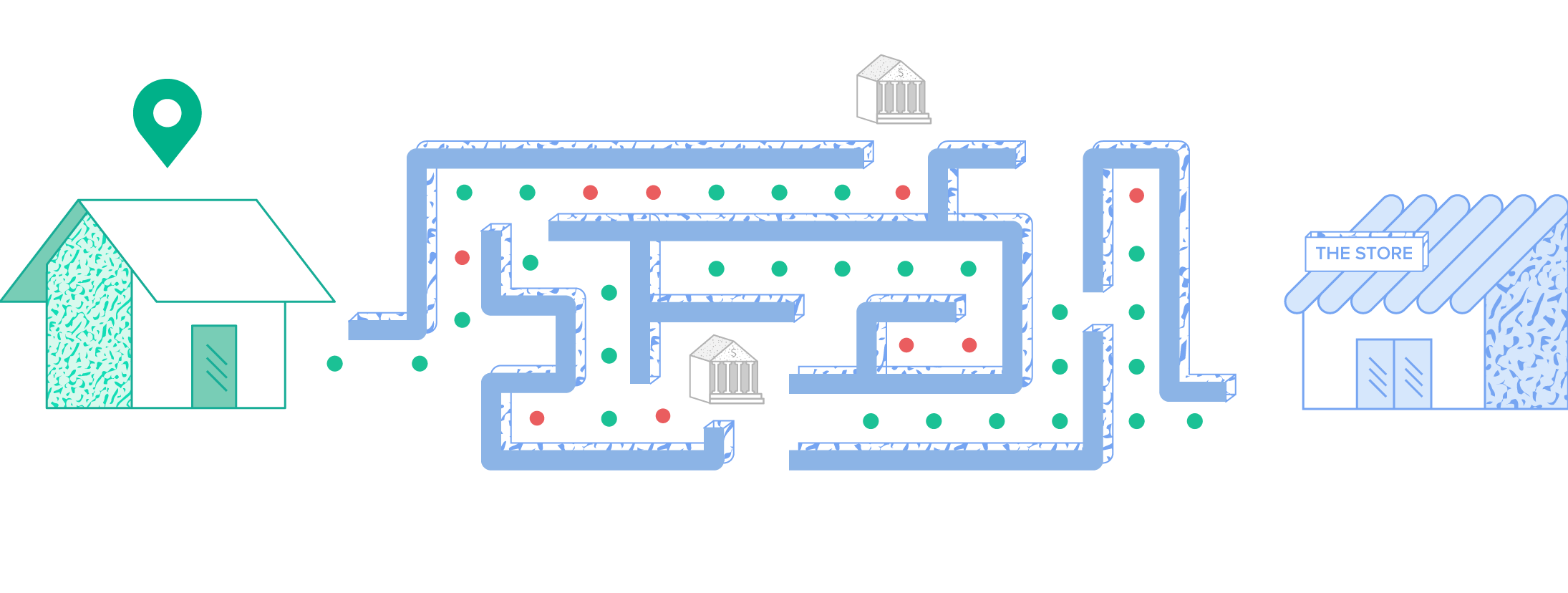

We’ve written extensively in this blog about the scope and cost of false declines. Riskified estimates fear of fraud leads merchants to decline good orders at a total value equivalent to 5.5% of their annual online revenue. But false declines are only one leak in the payment funnel – most merchants don’t realize that around 10% of orders placed at their online store are declined even before they have a chance to capture funds.

Based on Statista’s 2019 global ecommerce sales forecasts, the $48B paid in chargebacks, and the roughly $187B that will be lost to orders falsely declined at checkout, will be dwarfed by the $340B of potential revenue that fails payment authorization.

Riskified’s research into the authorization process uncovered that, for the average merchant, 1 in every 10 ecommerce dollars is declined during payment authorization – most frequently by the card issuer or payment gateway. And the really upsetting part? We’ve found that up to 70% of these declined orders are from good customers, who can afford to make the purchase. Adding insult to injury, shoppers don’t understand what’s going on behind the scenes and tend to blame the retailer for the payment decline – merchants are held responsible for rejecting orders they never even had the opportunity to accept.

Our new guide to payment declines helps merchants understand this mostly invisible problem, and gives tips to recover this lost revenue. In this guide we’ll explain:

- What are payment declines (and why merchants should care)

- Why it’s so hard to measure their impact on your business

- Where payment declines are most likely to occur (which goods & retailers)

- Who are the customers most likely to experience payment declines

- How merchants can recoup revenue lost to payment declines

What if you could capture 10% more orders?

The scope of the payment declines problem means it’s far too serious to be dismissed as a “cost of doing business”. To learn more about recovering revenue lost to payment declines, download our free guide.