When eCommerce Fraud Management Goes Wrong and Consumers Take to Social Media

Everything was perfect. An artful balance of targeted ads and endorsements by a handful of key influencers. A centrally located pop-up showroom powered by the latest technologies to pull data collected from customers online to use in store. The impeccably timed 10% discount offer via an email marketing campaign that led to the conversion: the consumer finally checks out an item that’s been sitting in her cart for weeks.

Seems perfect? Maybe, until she launches a tweet firestorm the next day complaining of an unauthorized charge and vows to never to shop that brand again.

The emergence of social media has given consumers a whole new way to interact with the brands they love, and … a forum to complain when brands disappoint. Of the many customer-support channels merchants and retailers optimize, social has the most at stake, because merchants’ every interaction with a customer is made public. That display can make or break a relationship with not only that one dissatisfied customer, but also with future potential customers who come across the conversation.

Manage social media well and it can become a valuable platform for merchants to showcase who they are. Ignore or neglect concerns voiced on social and see customer loyalty and brand value dip as your reputation takes a hit.

In this post we analyze real-life consumer complaints posted on Twitter to show how a smart eCommerce fraud-management system can help merchants reduce negative chatter on their social media accounts.

Why social media?

Merchants offer a stack of support channels to make sure their customers are well served. These can include phone, live chat, email, forums/message boards, self-serve knowledge base (FAQ), and social media. So what makes shoppers turn to Twitter or Instagram instead of sending an email to the [email protected] or calling the 1-800 hotline?

The three main draws to social are the following:

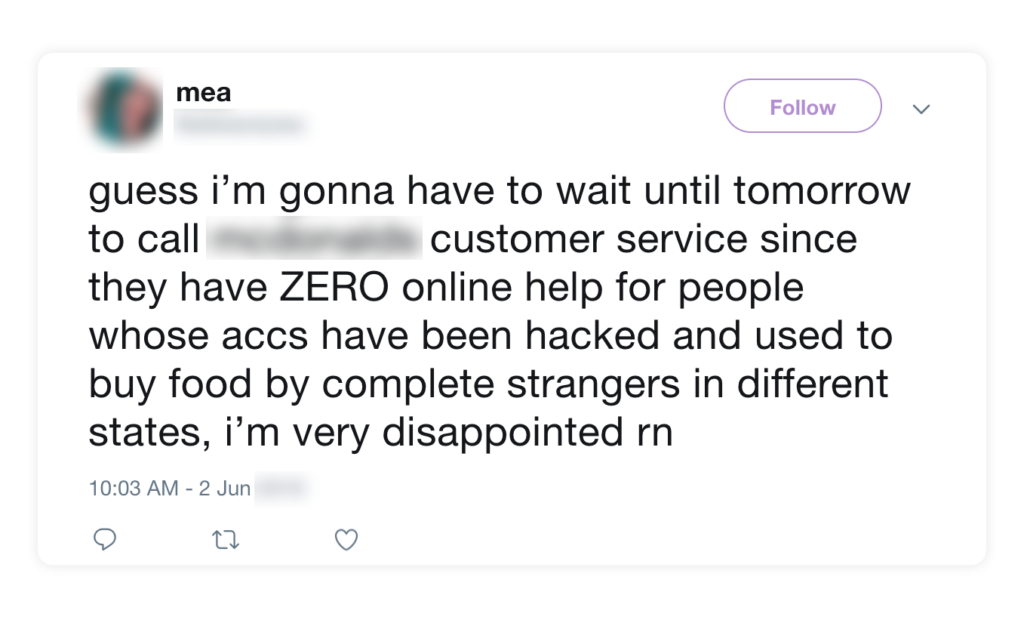

1. It’s quick. Social is often a last resort after not getting resolution through “traditional” support channels.

Consumers expect immediate response through social media because of its real-time, dynamic promise. Many customer complaints begin with exasperation over long hold times on the phone or limited business hours to speak to a support representative.

2. It’s easy. More internet- or social-savvy consumers, who are usually younger, use social media as their first point of contact for customer support needs.

Internet users are spending an average of 2 hours and 22 minutes a day on social networking and messaging platforms, according to GWI. Millennials, or those between ages 25 and 34, spend 2 hours and 37 minutes on social media, or nearly a third of the average eight-hour work day. The younger demographic, between ages 16-24 spend three hours a day on social media, which is equivalent to spending 42% of their seven hours at school every day. Considering how much time younger internet users spend on social media, it’s logical that they feel most comfortable with social media for interacting with merchants.

3. It’s public. Even if the issue was resolved, many consumers take to social to post a “public service announcement” about the (often negative) experience.

While it’s impossible to read the minds of these tweeters, it’s evident that the main goals for the consumer is to blow off some steam and perhaps get some discount codes or freebies in exchange for their “distress.” This type of post is most frustrating for merchants, as there is no tangible action they could take to undo the damage their brand is suffering.

How to manage and eventually reduce the number of these posts

The simplest way to cut down on the number of customer complaints on social media is by eliminating reasons for customers to complain. So what are the root incidents that compel customers to take to Twitter?

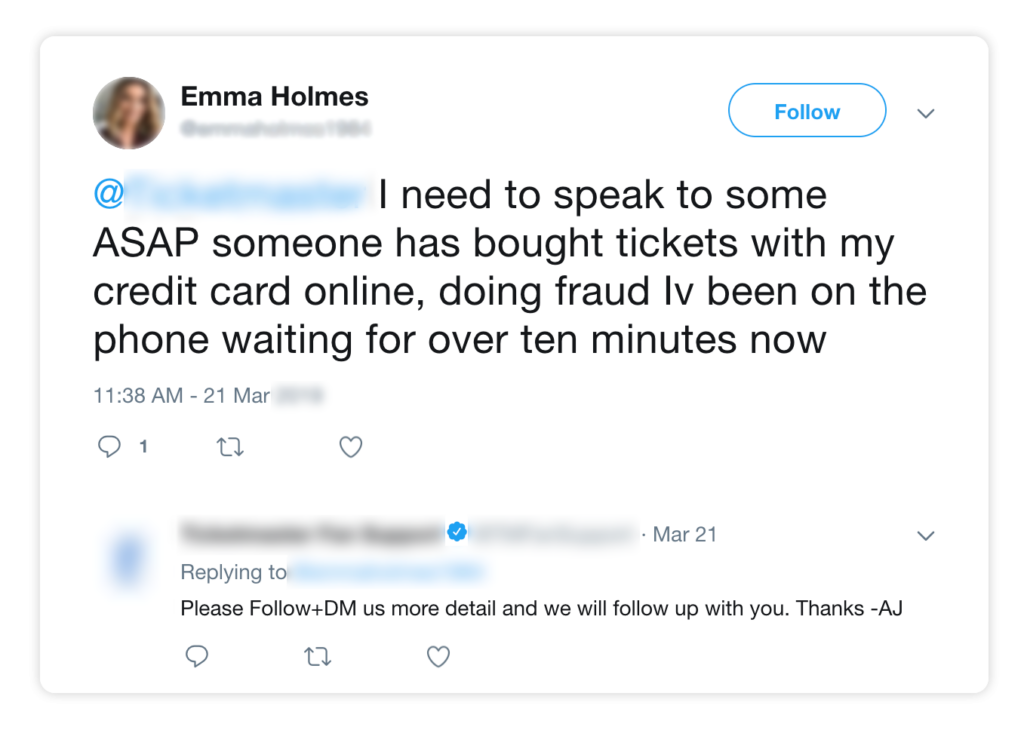

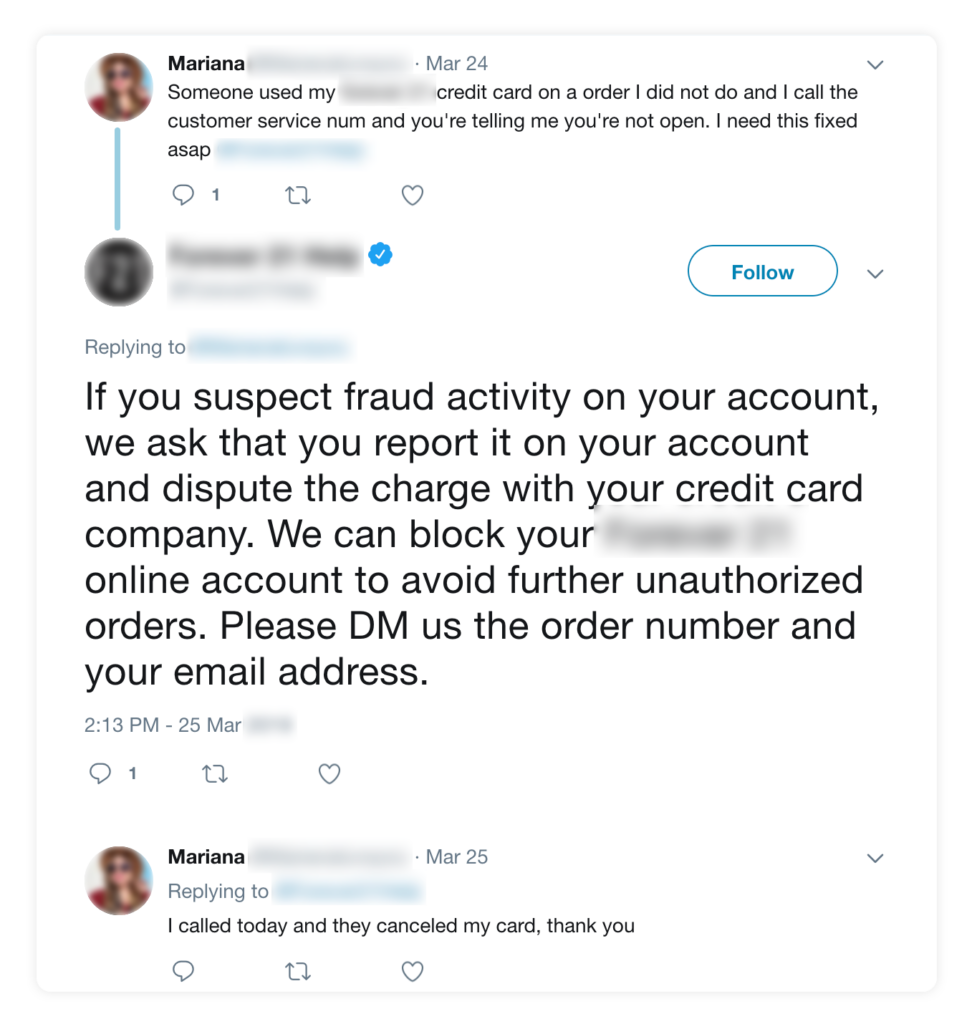

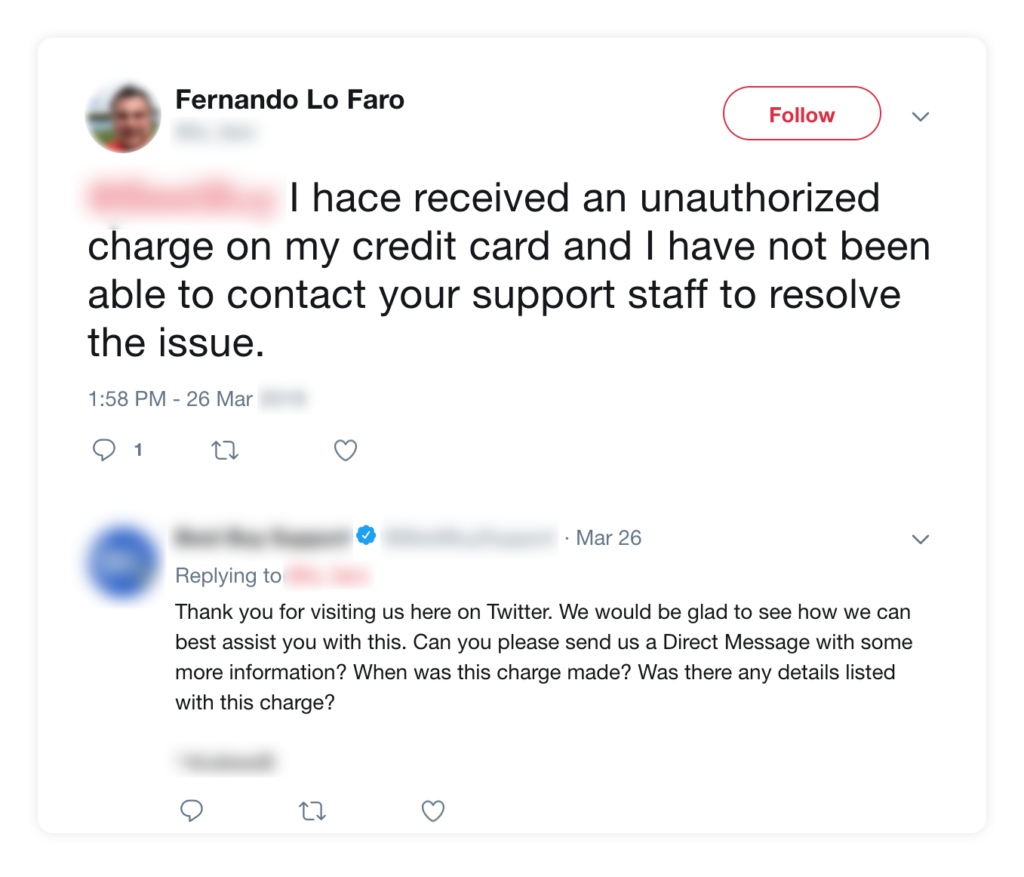

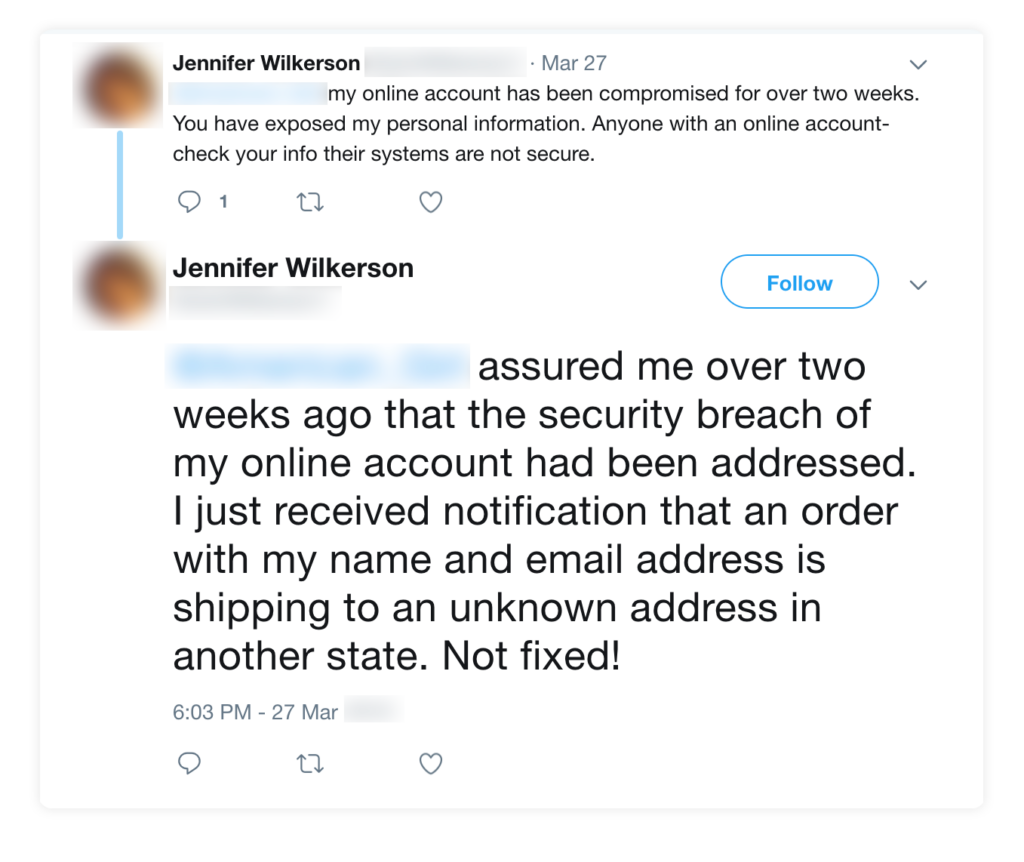

Victims of actual fraud are consumers who believe they may be victims of actual or attempted fraud, and then tweet about their concerns in the following ways. They report seeing an unauthorized charge on their credit card or form of payment.

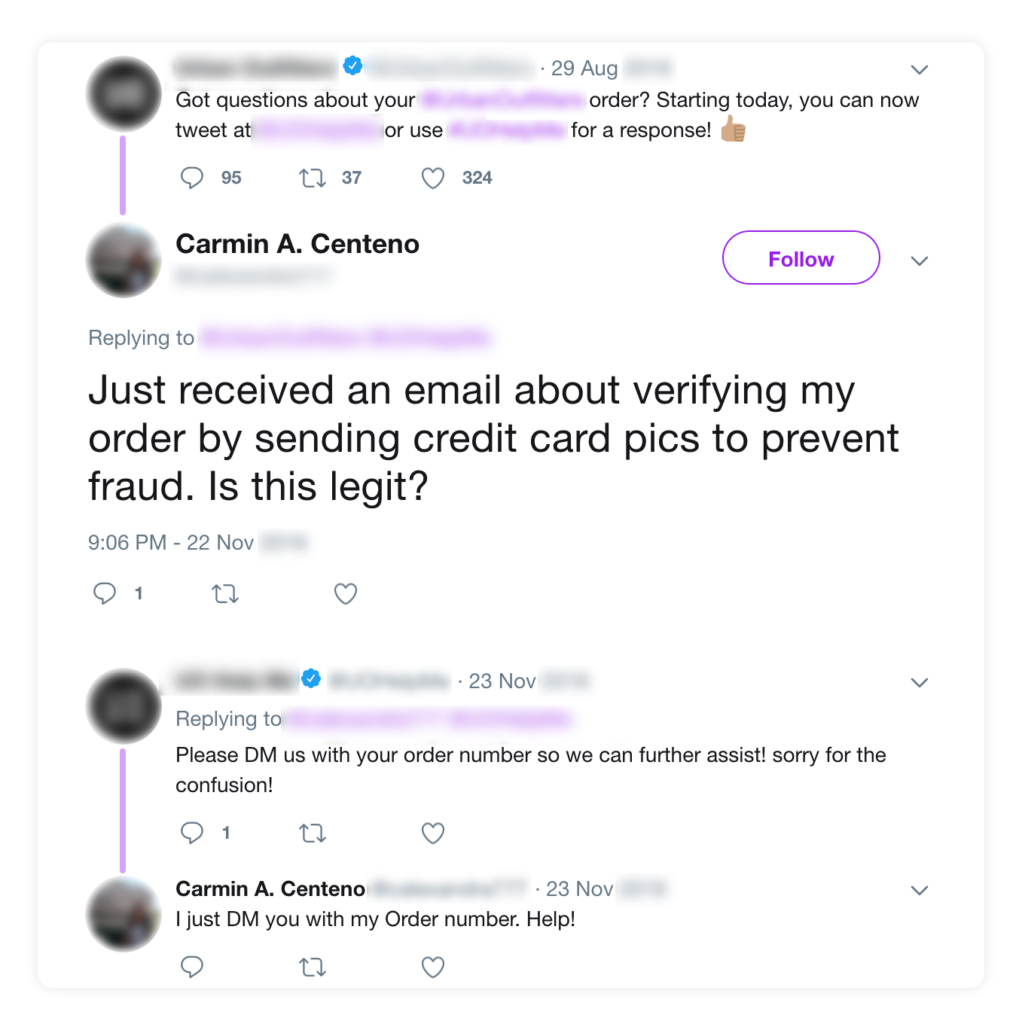

Or they have received a notification, via email, on a mobile app, or text message, asking to confirm an unauthorized or unfamiliar order.

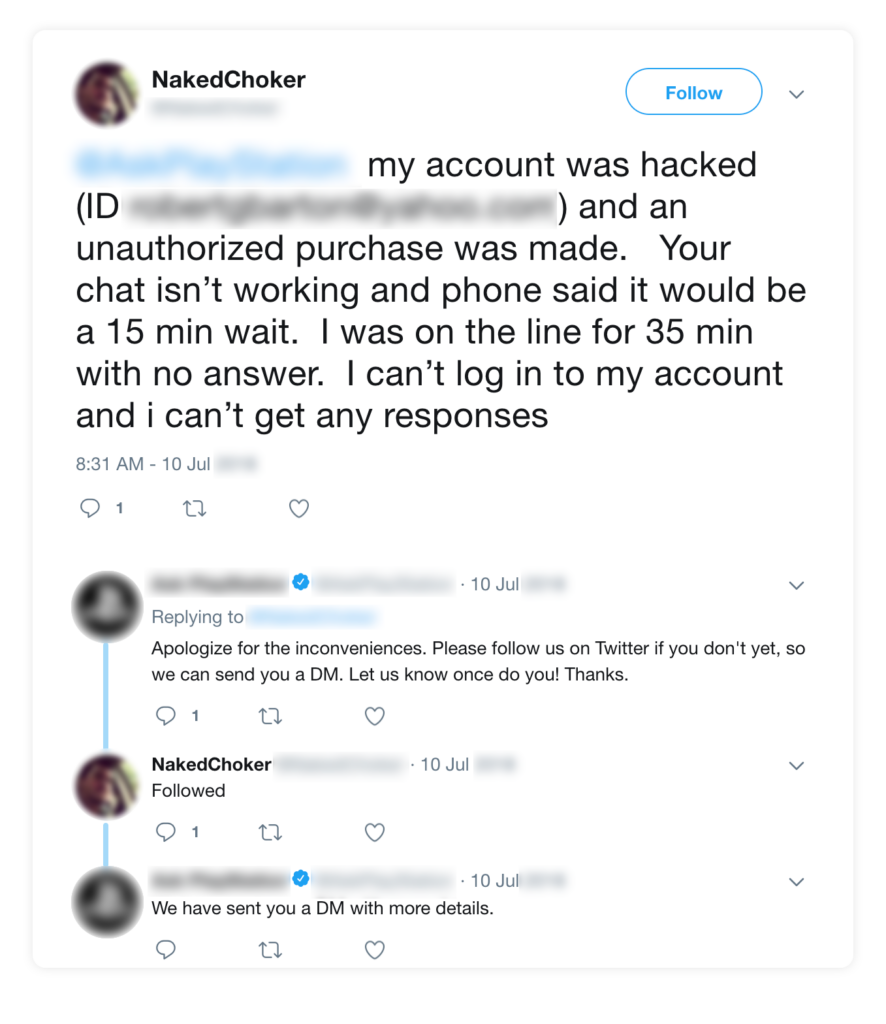

Lastly, they report unauthorized use of their account with the merchant. They notice this by suddenly losing access to the account, because their password had been changed by the hacker or fraudster, or an unfamiliar address is suddenly listed as a shipping address. They also could receive notifications for an order they do not recognize being shipped to an unknown address.

Even with the limited information and context provided in these tweets, it is clear that there has been some form of eCommerce fraud or an attempt to commit such fraud.

Jennifer Wilkerson was notified that someone logged into her account with merchant A, without her knowing and placed an order in her name and email address to an unknown shipping address in another state. This unauthorized access to her account means A fraud system is vulnerable to account takeover. Jennifer Wilkerson makes it clear that her confidence in A is under question, and warns others to check their accounts and also possibly reconsider their faith in the merchant’s security offerings.

Same goes for NakedChoker. The fraudster was so close to succeeding that a verification request for the order with merchant U was sent. In a way U’s fraud-prevention measures worked as they should, because NakedChoker learned about this unauthorized order before it went through. At the same time, the fact that the fraudster even made it this far will raise doubts for NakedChoker as to whether the brand is able to securely manage and protect her information from abuse.

For at least some of these tweeters, damages can be minimized or possibly even fully repaired. The consumer can immediately file a dispute with his or her credit card issuer, decline the unauthorized order verification notice and work with the merchant to secure his or her account and information. While this is added friction and annoyance, the consumer is unlikely to incur long-term financial damages.

However, it’s not so simple for merchants. Not only have they lost a valuable customer they spent time, effort, and resources trying to acquire, they now have racked up additional costs associated with the fraud or attempted fraud. If the fraud was successful, then the merchants have now lost the goods, cost of fulfillment and the chargeback fee. If these types of incidents are frequent, the merchant’s chargeback rate will go up, which may lead to being put on an excessive chargeback program and paying additional monthly fees.

Less discussed is the impact these events have on long-term profitability. Merchants have to do damage control on the fallout from having a public tweet that calls out their shortcomings. By failing to prevent fraud in the first place, the merchant may lose not only that customer but possibly many future customers as they may choose to shop elsewhere after seeing the tweets.

Fraud has multiple points of entry in the many steps of the customer journey, from login to checkout. That is why it’s important for merchants to have an end-to-end fraud-management system, equipped with tools such as Account Protection by Riskified. This service uses core technology, including bot detection, device fingerprinting and dynamic linking , and applies it to monitor non-purchase events such as new recipients, account updates, logins, and wishlist additions for analysis with revised models. With Account Protection, Jennifer Wilkerson’s account could have been flagged and prompted for verification as the fraudster was trying to place the order. That means Jennifer Wilkerson may never have taken to Twitter to voice the unauthorized order made in her name.

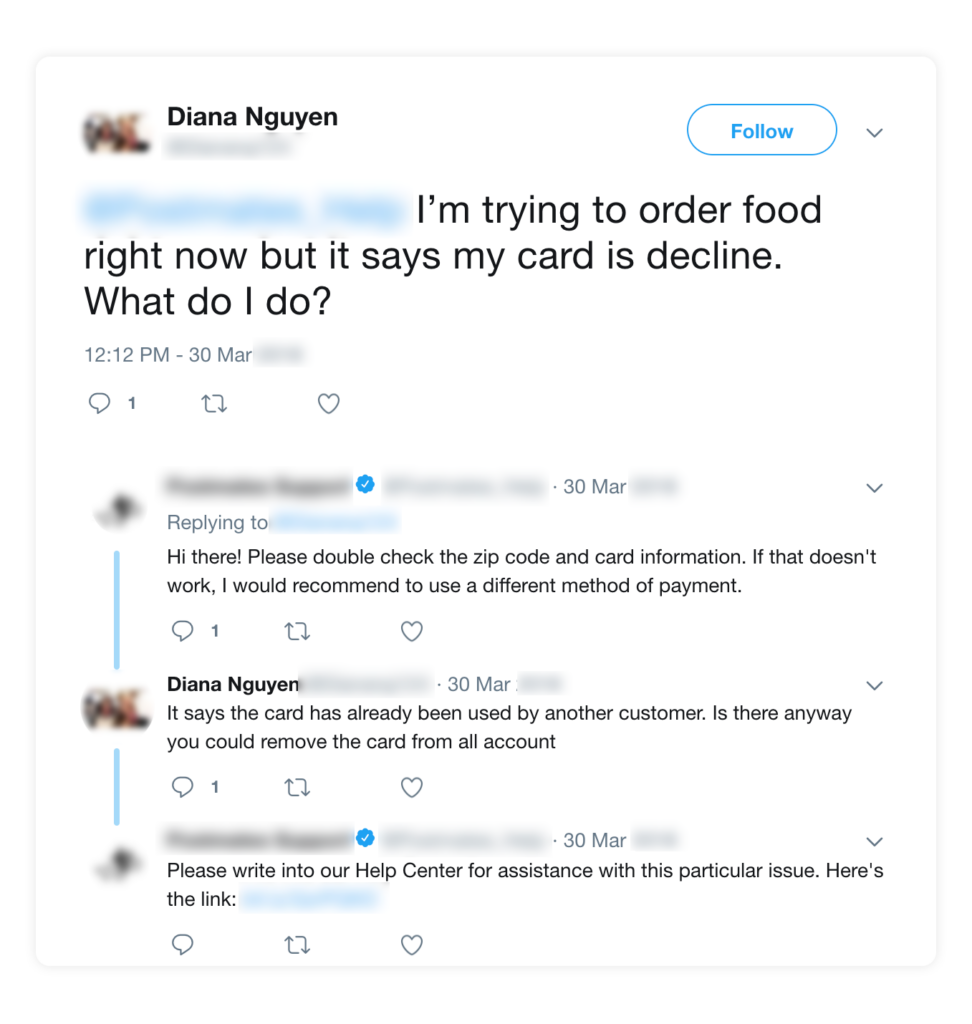

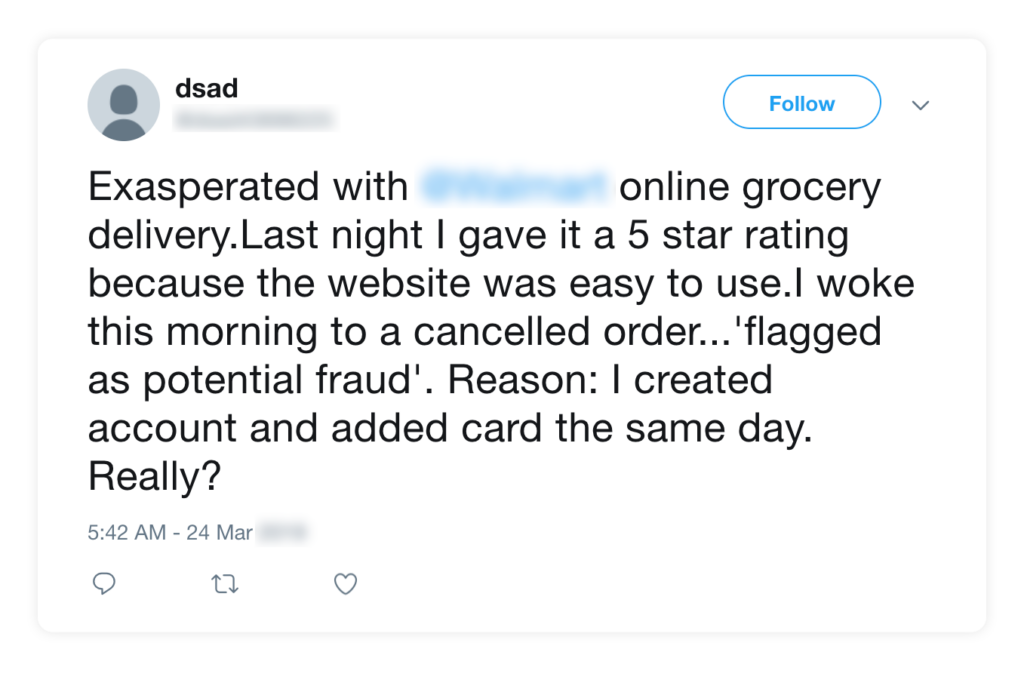

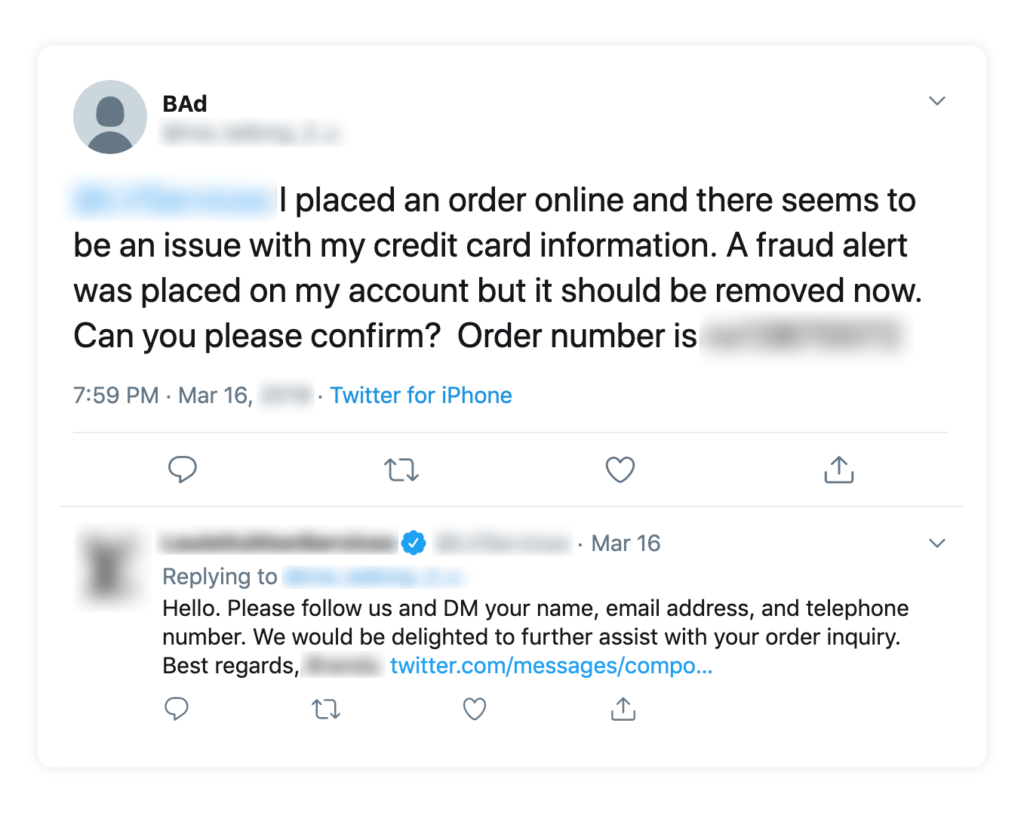

Victim to false declines

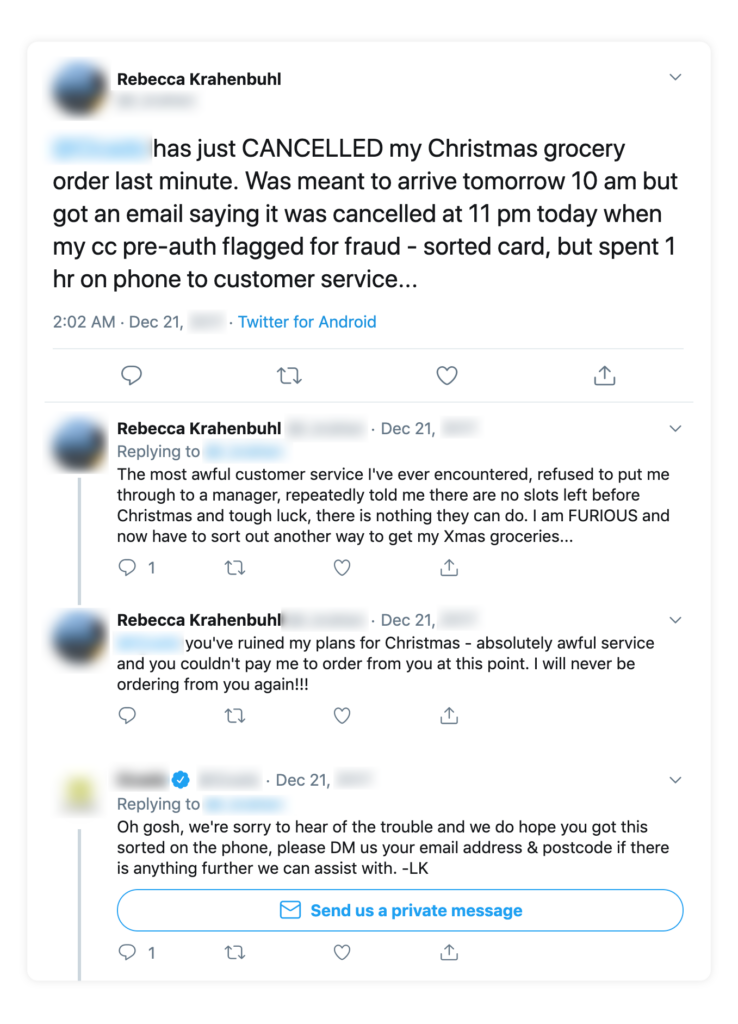

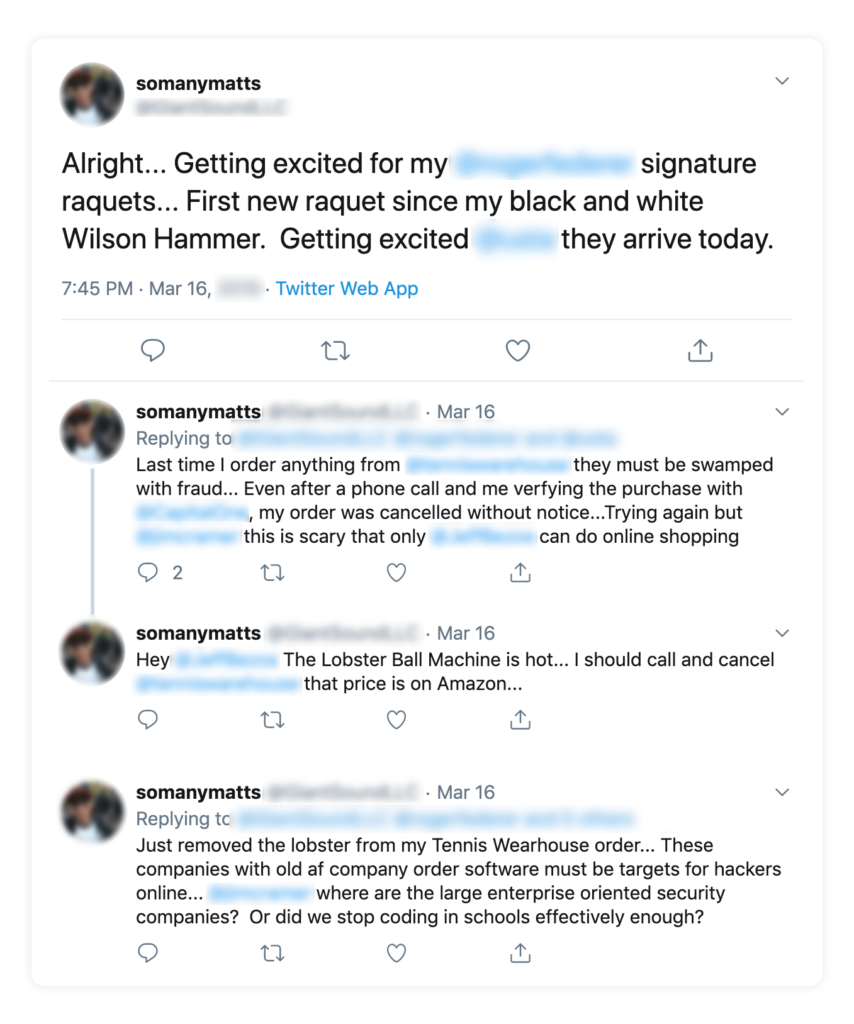

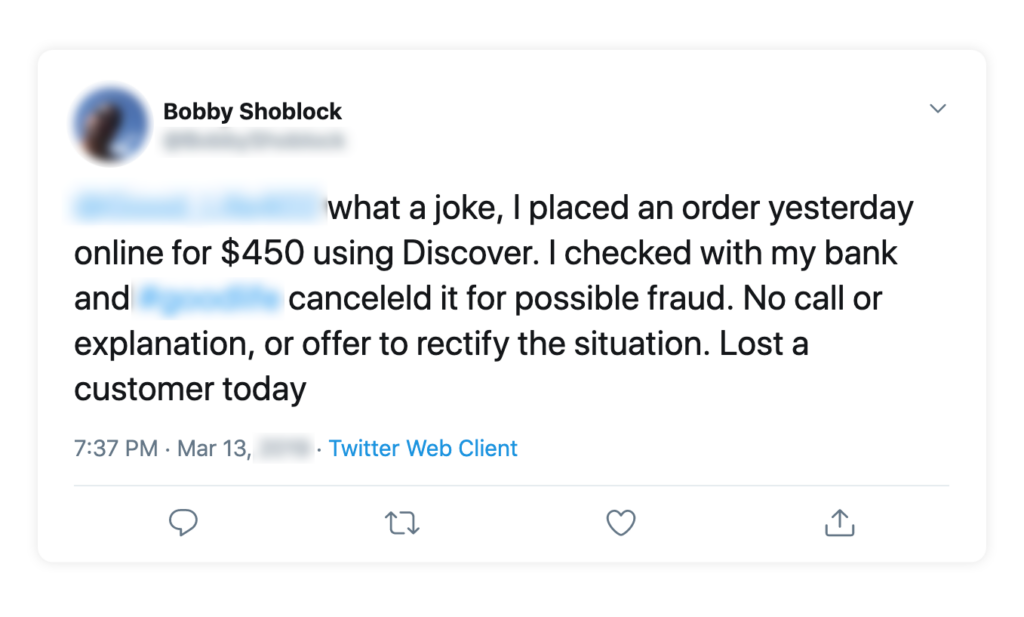

Consumers fall victim to false declines when they are mistaken for fraudsters and have their orders incorrectly turned away. These are some of the most common complaints we see on Twitter, where shoppers discovered their orders were flagged as potential fraud and unilaterally cancelled without notice.

Depending on the notifications they receive, shoppers can distinguish false declines by merchant or by the card issuer. However, shoppers largely don’t care who declined them and instead often blame the merchant or retailer for the declines. What aggravates shoppers further is the lack of timely communication around the decline, and the lack of notice that their orders were being cancelled.

In our experience, merchants often falsely decline customers when they have outdated fraud-management practices in place that aren’t taking advantage of the latest technologies and tactics. These merchants often have fraud teams still doing manual review, and usually use rules-based or scoring systems that automatically decline legitimate customer groups. These retailers don’t have to suffer any longer: they can grow online revenue and customer conversion while cutting overhead costs by automating online order review, just as Finish Line has.

When it comes to payment declines, or transactions that fail the payment authorization process, the fix may be beyond their reach. The payment gateway and card issuer are responsible for the vast majority of payment declines, and their reasons for declining to authorize the payment vary. It could be the card has surpassed its credit limit, there is a technical issue with the card, or the transaction is a suspected fraud attempt. Merchants can’t address the reasons behind payment declines, and so they can’t control the decision that’s made. But that doesn’t mean they are not an urgent concern for merchants to address.

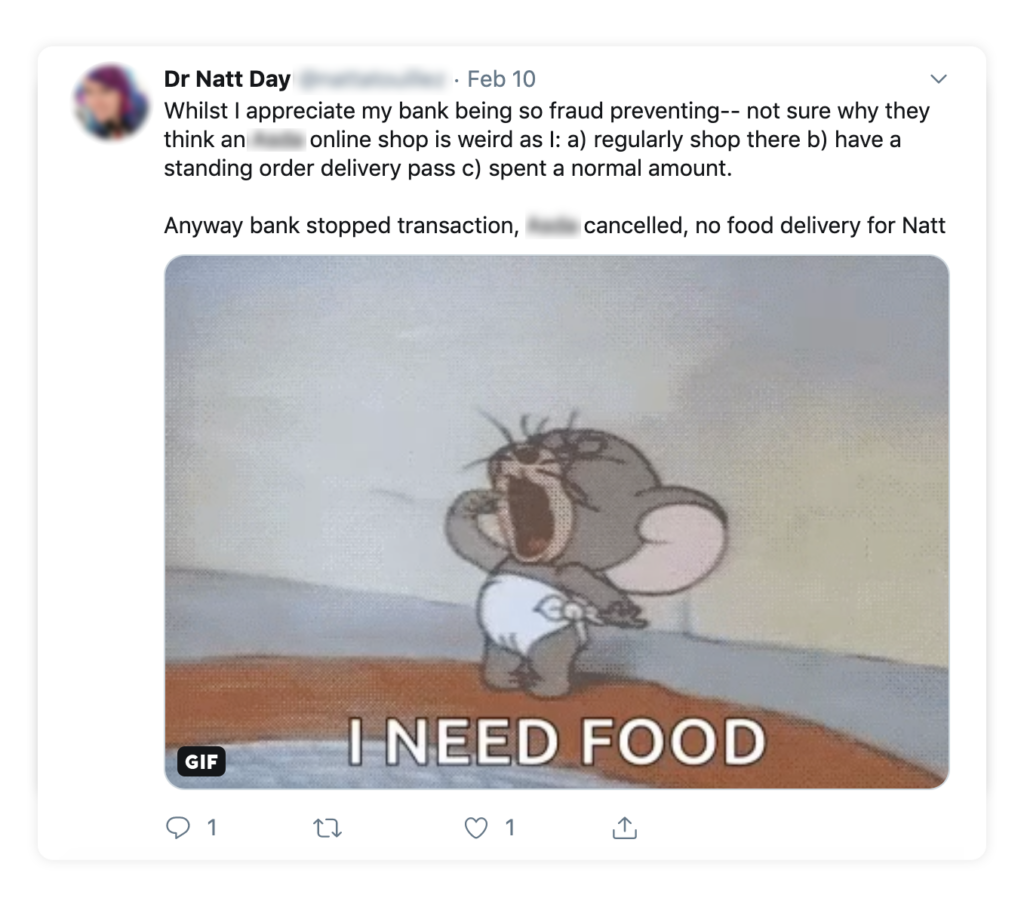

Managing general outrage posts

The final batch of social media complaints are by consumers who have fallen victim to general customer service mishaps. These types of posts don’t generally have a call to action for the merchant, because the issue has either been already resolved, or is no longer relevant. These types of posts serve more as an emotional outlet for shoppers’ frustrations than as a request for actionable assistance or resolution.

Sure, the merchant can share a promo code or make a one-time gift card offer as an apology for the dissatisfactory experience the shopper had. But that still means an increase in the customer acquisition cost without a guarantee that the customer will shop with the merchant again.

As frustrating as these posts are, merchants can reduce their likelihood by improving their fraud-prevention operations and reducing the chances of fraud and customer ire over annoying friction. That will enable the support team to focus on addressing other shopper concerns or queries and provide excellent customer service.

American Express 2017 Customer Service Barometer found that 50% of US consumers have abandoned a purchase due to a poor customer service experience. Also, 7 in 10 shoppers said they will spend more money (17% more on average) with a business that provides consistently great customer service. And 33% of customers say they’d look to switch to a competitor after a single bad service experience.

So lighten the customer service load by erasing eCommerce fraud-related complaints with a full-stack solution that helps you focus on increasing revenue and making customers happy. Reach out or read more on the best way to communicate with declined customers!