It’s the Back-to-School Shopping Season: 3 Students You Are Falsely Declining

Record back-to-school “holiday season”

Online merchants rely on increased sales during holiday seasons to boost their revenue—and the back-to-school season is no different. This year, college students in the US are expected to spend over $70B , exceeding recent years’ spending. The return to the classroom bodes sales lifts for retailers across many sectors, including apparel, electronics, household supplies, and furniture.

An opportunity for merchants is also an opportunity for fraudsters

As with any online sales surge, fraudsters are quick to emulate the behavior of good customers in an attempt to blend into the crowd and go undetected. In order to increase sales, boost approval rates and improve customer experience, merchants need to be able to differentiate between legitimate customers and fraudsters. We have identified three student personas that may appear to be risky, but in fact represent common back-to-school consumer behaviors. Merchants that familiarize themselves with these patterns can avoid falsely declining good customers and take full advantage of the season.

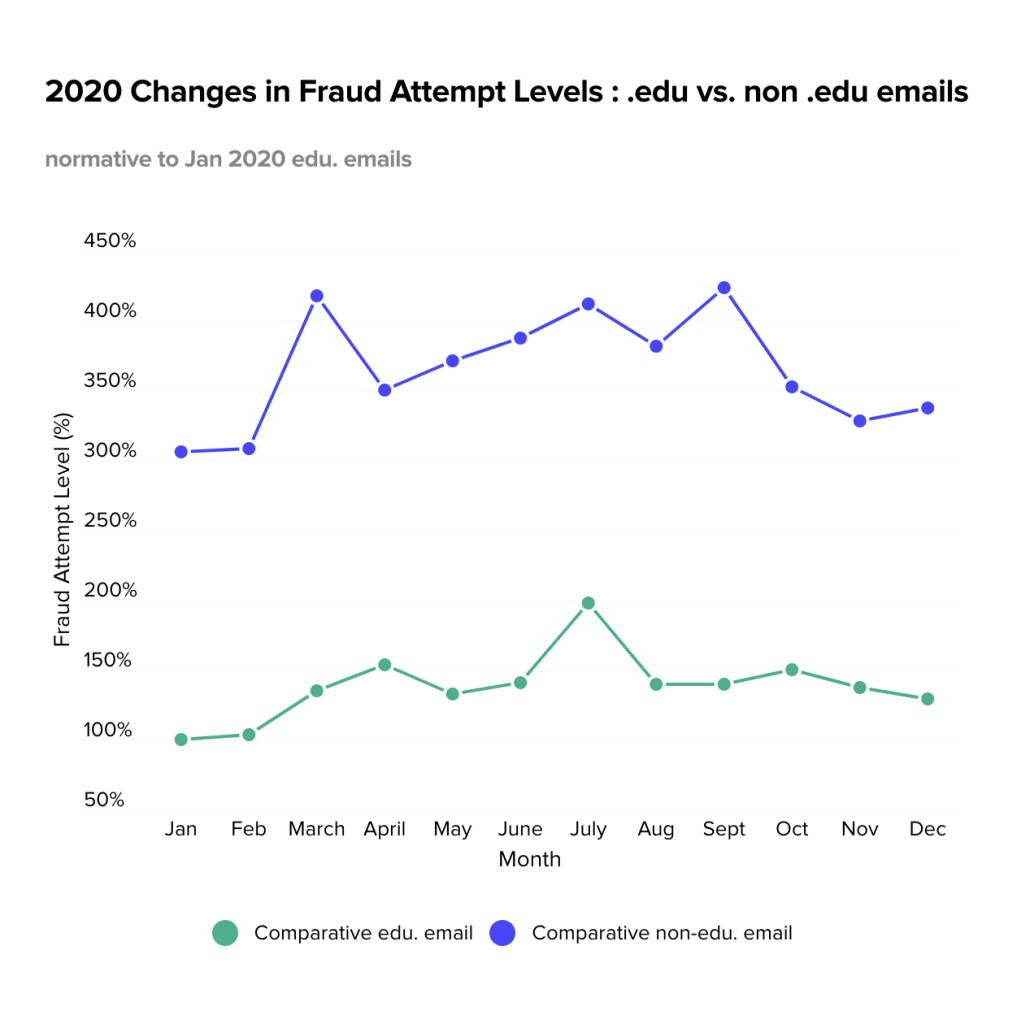

1. New students with new .edu email addresses

As new students start a new school year they look to shop for their essentials, often using their brand-new institutional .edu email addresses to take advantage of exclusive discounts. First-time customers are an opportunity for merchants to increase revenue, but they are also perceived as risky. No purchase history is available to corroborate their identities, so it is essential that merchants have a robust fraud detection strategy, ensuring they are not falsely declining new legitimate customers. Based on Riskified 2020 data, this challenge is true throughout the year, but in August-September the risk of false declines is at its peak, with rates increasing up to 10%.

So how can merchants recognize these new customers? Institutional email usage rises both as the new school year begins and during eCommerce holidays, when more student discounts are available. The good news for merchants is that these emails are significantly safer than non-institutional new emails, which carry 2.8x the risk.

2. Students who move and don’t update their address

University students often move away for the school year, be it locally to on-campus dorms or to an entirely different city or even country. However, they often won’t update their address with their bank, leading to a mismatch between the billing and shipping addresses which can be perceived as risky and cause false declines. Rigid fraud rules often decline transactions with a mismatch between the billing and shipping addresses, or an AVS mismatch between the provided billing address and the one the bank has on file. Merchants need to take into account other data points to filter out the bad actors from the students who simply haven’t updated their address.

3. International students should make the grade

Merchants should also factor in for international students. Despite the pandemic, in 2020 more than one million international students were enrolled in higher education in the US and over half a million in both the United Kingdom and Canada. In addition to potential address mismatches, merchants should watch out for other common “red flags” that may actually be legitimate customer behavior in this case:

- A foreign student using an international credit card, with an international billing address but domestic shipping address.

- A difference between the IP address and shipping or billing address should be further investigated to explore if it belongs to a campus or educational institution.

- The use of multiple, seemingly unrelated keyboard languages is often an indicator of fraud but may just be the legitimate behavior of an international student.

Know your students: Increase revenue, gain happy customers

Riskified estimates that as many as 66% of orders declined by merchants are actually legitimate orders. To prevent false declines, ensuring both happy customers and increased revenue, retailers need to acquaint themselves with the unique, seasonal back-to-school patterns and expected customers. Tackling fraud means having a dynamic, innovative approach, challenging existing assumptions and adapting the way merchants review purchases and account information. By examining hundreds of data points, merchants can stay one step ahead of the fraudsters, prevent false declines and optimize the potential of the lucrative back-to-school season.