How fraudsters get their kicks: data shows sneaker industry fraud on the rise

What fashion items are most popular with online thieves? Riskified’s annual analysis of fraud trends across the fashion industry reveals that sneakers are by far the most susceptible and far more at risk than even electronics or jewelry. The analysis focused specifically on the subcategories of low- to mid-range fashion, sneakers, and high-end fashion and used device data and behavioral insights collected from the Riskified platform.

Sneakers are the riskiest fashion items by a large margin, 162% above the baseline average across all industries. This exceeds high-end fashion clothing (69% riskier than average), making these two categories the only ones with an above-average score when compared to electronics, jewelry and watches, cosmetics, low- to mid-range fashion, home, and other retailers.

A trend is afoot

While sneakers have long been seen as the riskiest compared to other categories in the fashion industry, in the past year, the gap grew even wider. This is likely due to the booming sneaker resale market that continues to mushroom, such as the run on limited edition Jordan 1s by resellers, knowing that demand will stay high. The sneaker resale market is expected to generate $30 billion by 2030 — and provides a convenient and lucrative opportunity for fraudsters to profit from a liquid market.

Furthermore, in the past few years, sneakers have become an investment asset. The economic uncertainties of 2022 likely reinforced this trend, causing sneakers to become a type of “crisis commodity” that holds value, similar to precious metals.

New account, old problem

To grow, you need to gain new customers. However, while there are varied trends in each subcategory, the data shows that the “new accounts”1 segment is consistently riskier than the known account segment.

In the sneakers subcategory, returning customers make up the majority of the legitimate customers. Within the fraudulent population, there is more of a balance between old and “new,” as bad actors can leverage multiple accounts in an attempt to hide malicious activity and promotional discount or referral program abuse.

If we take an even closer look at the sneakers segment:

- “New customers” are riskier. The yearly risk level average for new customers was almost twice as high as established customers.

- “New customers” are more likely to be fraudsters. The new customer group’s average share of legitimate transactions was about a third, while its share of fraudulent transactions was about half vs returning customers.

- “New customers” proportional representation among the legitimate and fraudulent populations remained stable throughout the year.

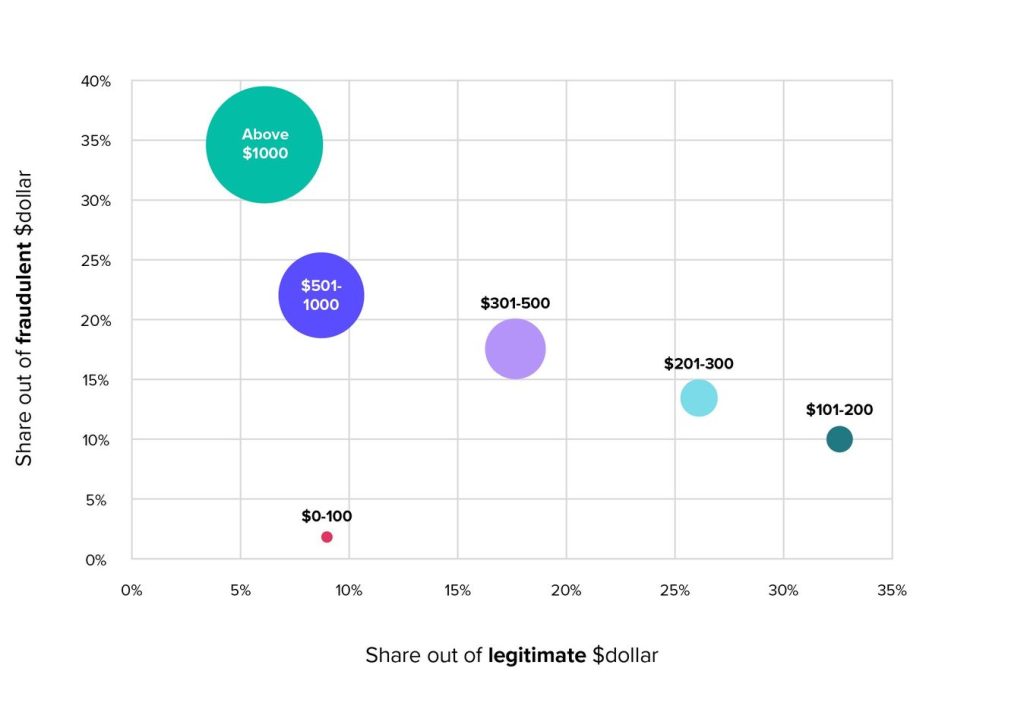

Higher spend = higher risk

Riskified’s analysis also revealed that orders of between $100 and $300 are the most challenging dollar value range when it comes to risk and fraud. While accounting for more than half of legitimate orders (in terms of both volume and dollars), this range also accounts for about half of the fraudulent volume. This might indicate that merchants face difficulty in distinguishing good orders from fraudulent ones in this range, which can result in higher operational efforts and costs. In addition, this dollar range experienced the most significant increase in risk levels throughout the given time frame (between 2021 and 2022).

Interestingly, the data showed that the lowest dollar amount bucket (under $100) has a similar contribution to the legitimate dollar sales revenue as the $500-$1,000 range, meaning that lower-priced transactions are more likely to be legitimate. The riskiness gap between these two buckets though is very significant, and the $500-$1,000 bucket has significantly more potential to negatively impact sneaker merchants’ fraud costs.

In general, the highest-dollar buckets (those above $500) are the riskiest (based on risk levels). They make up more than half of the fraudulent transactions in terms of dollar value but are significantly less popular among the legitimate population, and their contribution to legitimate dollar revenue is relatively small.

Riskiness & popularity by order amount (in $dollars) – sneakers

Beyond sneakers: a look at gift cards and grift

But what about fashion and sneaker brand gift cards? In general, the data showed that fashion digital gift cards are much riskier compared to fashion physical goods.

Throughout 2022, the fashion industry showed a clear increase in the risk level of gift cards. In September, the share of gift cards out of the total fraudulent attempt transactions volume was more than 2.5x higher than in January.

Based on Riskified’s experience, online gift card fraud schemes in the fashion industry are often characterized by a massive fraud wave with abnormal increases in general transaction volumes.

The fashion industry experiences a relatively low volume of digital gift card purchases, so these abnormal fraudulent behaviors result in very high-risk levels for this segment.

Watch proxy IP2, but tread lightly

While it is reasonable to assume that fraudsters often use proxies to conceal their true IP addresses (and, therefore, the geographic location of the device), there are also many legitimate reasons for using proxy servers, such as anonymous browsing and access to geo-locked websites. So basing a decision mainly on proxy indication can lead to falsely declining good customers.

However, according to Riskified’s analysis, proxy transactions within all three industries analyzed (high-end, low- to mid-range fashion, and sneakers) are significantly riskier than non-proxy transactions. Nonetheless, it’s important to emphasize that proxy connection riskiness should be considered within a transaction context and, in most cases, does not definitively indicate fraudulent activity.

Taking a closer look at the sneakers category:

- In general, proxy transactions are significantly riskier compared to non-proxy transactions.

- Both proxy and non-proxy IPs experienced an increase in risk levels throughout 2022, and the risk gap between these two segments widened.

- Proxy use is more popular among fraudsters. The yearly averages show that the proxy segment takes a relatively small piece of the total legitimate transactions (<7%), while its share out of fraudulent transactions is significantly higher (just above 20%).

Like a great sneaker story? See how Finish Line cut costs and got growth sprinting with Riskified here. Want to dig deeper into the data or find out what you can do? Speak to our team of fraud experts.

1 New Customers are New Registered Accounts with a merchant (i.e the account was registered up to 30 days previous to the purchase date). Accounts that are 30+ days old when an order was placed are considered Old/Returning Customers. Important note: customers that are new to the merchant are not necessarily new to Riskified.

2 In the context of CNP transactions, proxy usage refers to cases in which rather than browsing a retailer’s website directly from the server closest to their device, customers connect via an additional server. Riskified’s proprietary technology allows our systems to accurately determine whether a proxy server was used while placing an order.