Lorna Jane strengthens authorization rates with Riskified

See how Riskified helped Lorna Jane approve as many good orders as possible, reduce fraud, and lift overall conversions

- 13% authorization increase

- 98% reduction in chargebacks

- 54% decrease in cost of fraud

Meet Lorna Jane

Fitness instructor and activewear pioneer Lorna Jane Clarkson founded Australia-based retailer Lorna Jane in 1989. The brand’s mission remains to inspire its customers to live the life they love through Active Living™. With a passion for fashion and fitness, Lorna Jane inspires women worldwide to embrace their unique journey toward health and wellness. The brand’s collection of stylish and functional activewear supports women in every step of their active lifestyle, ensuring comfort, confidence, and performance. Crafted with premium fabrics and innovative designs, Lorna Jane offers a range of trendy and versatile apparel that seamlessly transitions from gym sessions to everyday adventures.

CTO, Lorna Jane

I had worked with Riskified before for fraud management, so I had seen firsthand how the technology could improve authorization rates and customer experience. I reconnected as soon as I understood Lorna Jane’s needs in this space.

The Challenge

When Peter Clarke first joined Lorna Jane as CTO, the brand’s fraud team faced a daunting combination of high chargebacks, low approval rates, and cumbersome manual processes. Its risk-scoring-based solution was generating a high number of false declines and friction for customers. At the same time, chargebacks hovered around 0.30%, with gift card chargebacks a particular problem.

As an Australian merchant, Lorna Jane must monitor chargebacks particularly closely or face sanctions by the Australian Payments Network (AusPayNet), a regulatory body for the Australian payments industry. AusPayNet sets rules for identifying merchants with excessive chargeback rates, and its thresholds are notoriously low.

This meant that Lorna Jane couldn’t just open the fraud floodgates to lift its approval rates. It needed a more sophisticated approach that would maximize approvals and minimize chargebacks at the same time.

Of course, the brand also had to be mindful of its customer experience and workflows. Manual reviews of transactions under its existing scoring system and a cumbersome dispute process created friction for customers and inefficiency for its fraud team.

Having worked with Riskified at a previous employer, Lorna Jane CTO Peter Clarke knew that an accountable partner with a machine learning approach could quickly bring all of these variables back into healthy balance.

CTO, Lorna Jane

The bump in authorization rates was immediate after deploying Riskified, taking us to about 95%. At the same time, we have since recorded virtually no chargebacks — fewer than 10 total in the first six months of 2023.

The Solution

Lorna Jane integrated Riskified as a pre-authorization fraud prevention and screening solution to not only remove fraud from ever reaching the issuers or banks, but also to authorize as many good orders as possible — this helped to reduce fraud and lift overall conversions. As soon as Riskified technology was in place at Lorna Jane, the brand began to see results. Soon after going live, Lorna Jane saw authorization rates rise from an average of ~82% to consistently between 95% and 98%.

Unlike a scoring solution, Riskified leverages machine learning to assess hundreds of relevant data attributes and uses intelligent global linking technology to draw insights from more than a billion historical transactions executed over its vast merchant network.

By filtering out bad orders ahead of authorization and approving more good ones, Riskified helped Lorna Jane boost conversions. Simultaneously, Lorna Jane’s chargebacks dropped substantially, which kept the company well off AusPayNet’s radar. Gift certificate chargebacks alone dropped to 0%. And because of Riskified’s Chargeback Guarantee, Lorna Jane removed the cost of chargebacks with Riskified taking full liability.

The Lorna Jane fraud team now spends far less time manually reviewing orders, which means less friction for good customers and allows resources to be allocated to revenue-generating projects.

New authorization rate

95% with Riskified

Chargebacks virtually eliminated

54% reduction in the cost of fraud

Riskified helps global retailers realize their full ecommerce potential

Download the case study and share it with your team

Download the case studySee how Ring was able to decline more than $4 million in abusive returns in just seven months.

Learn how Riskfied helps Hotelogical to maintain 46%+ chargeback dispute win rate while handling 5X the volume.

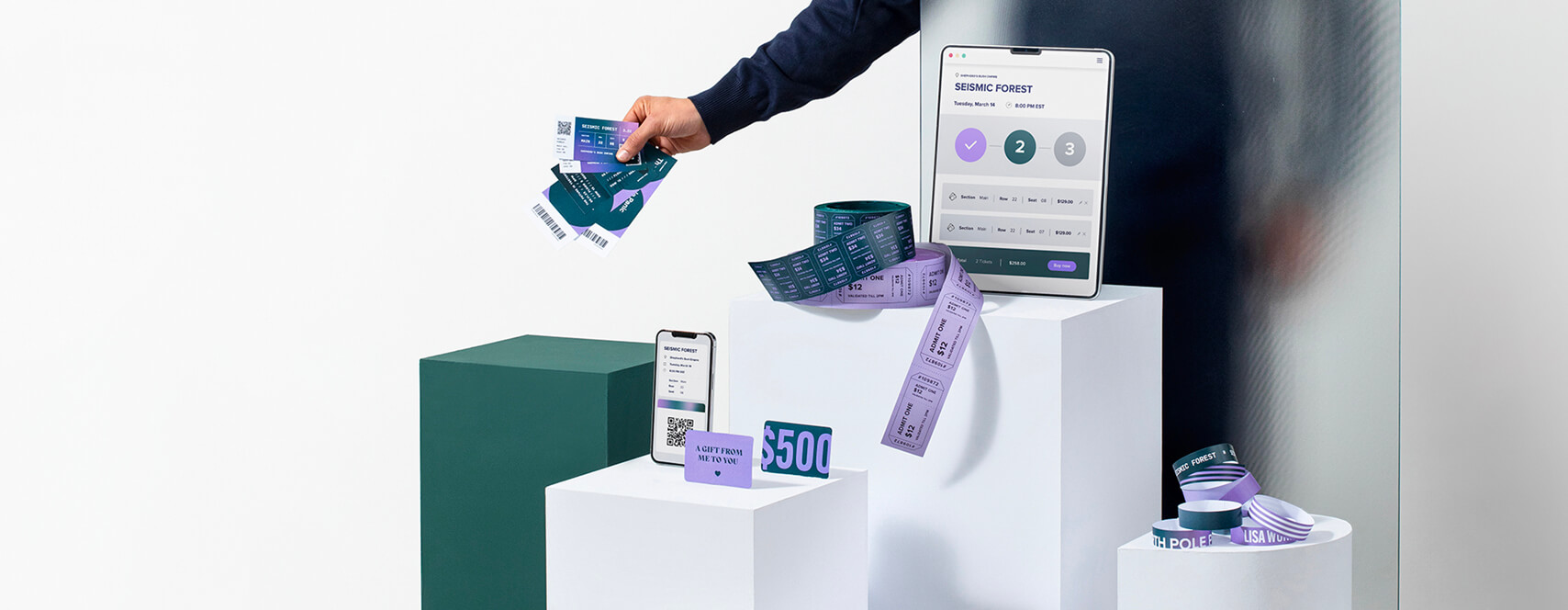

Learn how Riskified helps Gametime to improve fraud operational efficiencies and support business growth