Does your fraud strategy pass the Taylor Swift test? Don’t lose good bookings to bad technology

Air travel and events ticketing are both lucrative segments for fraudsters and can be risky for merchants. According to analysis by Riskified data analyst, Yael Hemo, and senior data analyst, Lev Gal, flight bookings in 2024 were +14% riskier compared to the previous year. Senior data analyst Adi Dick-Charnilas found that the events ticket industry showed a 22% yearly increase in fraud attempts. But with flights and live-event venues filling up in the post-pandemic economy, merchants can’t afford to mistake good customers for bad actors or vice versa. And with the wrong fraud technology, that’s exactly what can happen. (Cue I Did Something Bad)

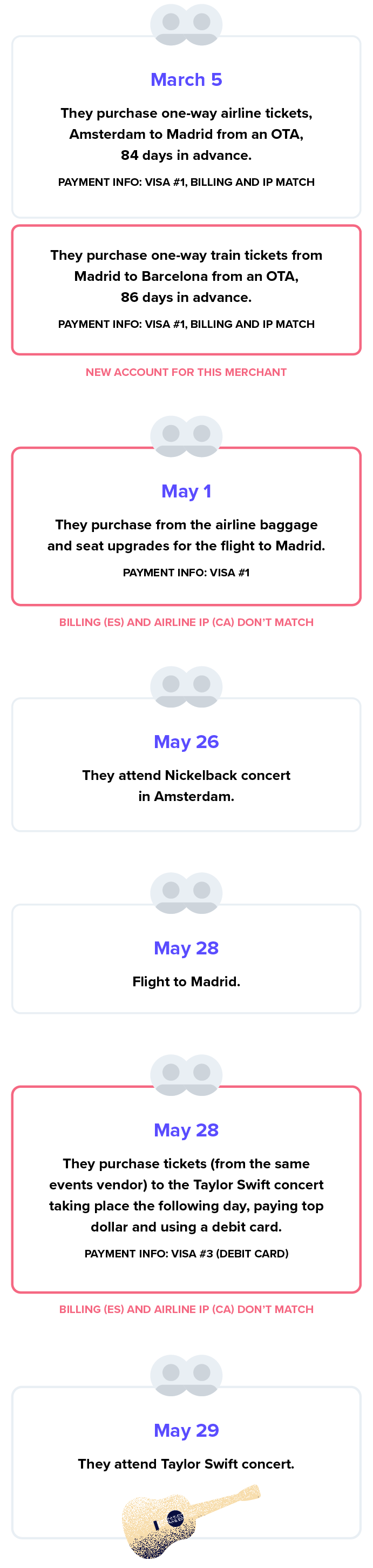

Here’s an example: A European adventure, Swiftie-style

A Canadian couple has a fantastic May trip planned during which they will travel to Amsterdam and then join up with friends in Spain to see Taylor Swift. Purchasing flight and train tickets maxed out the couple’s primary credit card , but they have money saved in their checking account and plan to buy their concert tickets closer to the date using a debit card.

After arriving in Amsterdam, a last-minute opportunity to see Nickelback arises, and they can’t resist, breaking out their emergency credit card for the unexpected splurge. (Cue Don’t Blame Me)

At this point, the couple’s itinerary will involve at least four different vendors (not even counting their travel from Canada) and multiple payment methods as they manage cash flow and credit card limits.

Clearly, these Canadians are avid travelers and big-spending music fans, so for travel merchants and ticket sellers, their loyalty is worth cultivating. But from a payments perspective, their spending habits have the potential to set off erroneous alarm bells for the vendors involved.

A strategic, rules-based approach to fraud detection could misread their behavior, triggering added friction or a declined transaction. That friction could disrupt their travel plans, their customer experience, and any future relationship with your business. (cue Bad Blood)

Turning red flags to green lights

On the other hand, an identity-based fraud detection solution drawing data from across a broader merchant network would recognize this couple in real time as low-risk. Using network data, this couple would be identified as legitimate across their entire buying journey and across payment methods, making both their purchase experience and their European adventure seamless.

With the right fraud technology, potential red flags instead become green lights, and these travelers become lifelong customers. (cue Love Story)

Would your fraud strategy pass the test?

Would your fraud technology pass the Taylor Swift test and approve this couple’s purchases? Or would gaps in your visibility cause you to miss out on this significant revenue opportunity and potentially future revenue from these lucrative customers?

For this couple, Riskified would have the full context of their journey from the travel plans they made months in advance to the last-minute concert tickets they purchased. Riskified’s identity resolution engine clusters data from a global network to recognize customer legitimacy in real-time, so the couple is recognized as low risk even when their spending looks suspicious. As a result, they proceed friction-free throughout their adventure, maximizing revenue and loyalty for the merchants involved.

Make the shift from rules-based system to real-time resolution

With Riskified, you can discern Swifties from scammers every time, even when they have complex and unusual purchasing habits.

Our machine learning algorithms look at an array of data points and touchpoints to evaluate connections and similarities across a wide network of merchants, so only fraud is blocked, not good revenue.

For one ticket marketplace, switching to Riskified boosted transaction success rates by 1.5% and customer satisfaction by 8%. And for air travel, Riskified allows merchants to more accurately and dynamically discern fraudulent behavior from legitimate activity, so they can also open doors to more customer-friendly policies that drive competitiveness and growth.

A dynamic, AI-powered approach helps travel and ticket merchants block fraudulent purchases and ensure good customers get the tickets and experiences they deserve. (Cue Karma)

Fraudsters have become especially active in the airline sector. Learn more in Riskified’s 2024 airlines travel report: Air travel is back: With growth headwinds (but less turbulence).