Decline less, convert more

Identify more good orders, boost authorization rates, and increase approval rates with intelligent, adaptive checkout flows.

Join global category leaders unleashing their ecommerce growth with us

Maximize conversion at checkout

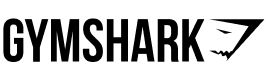

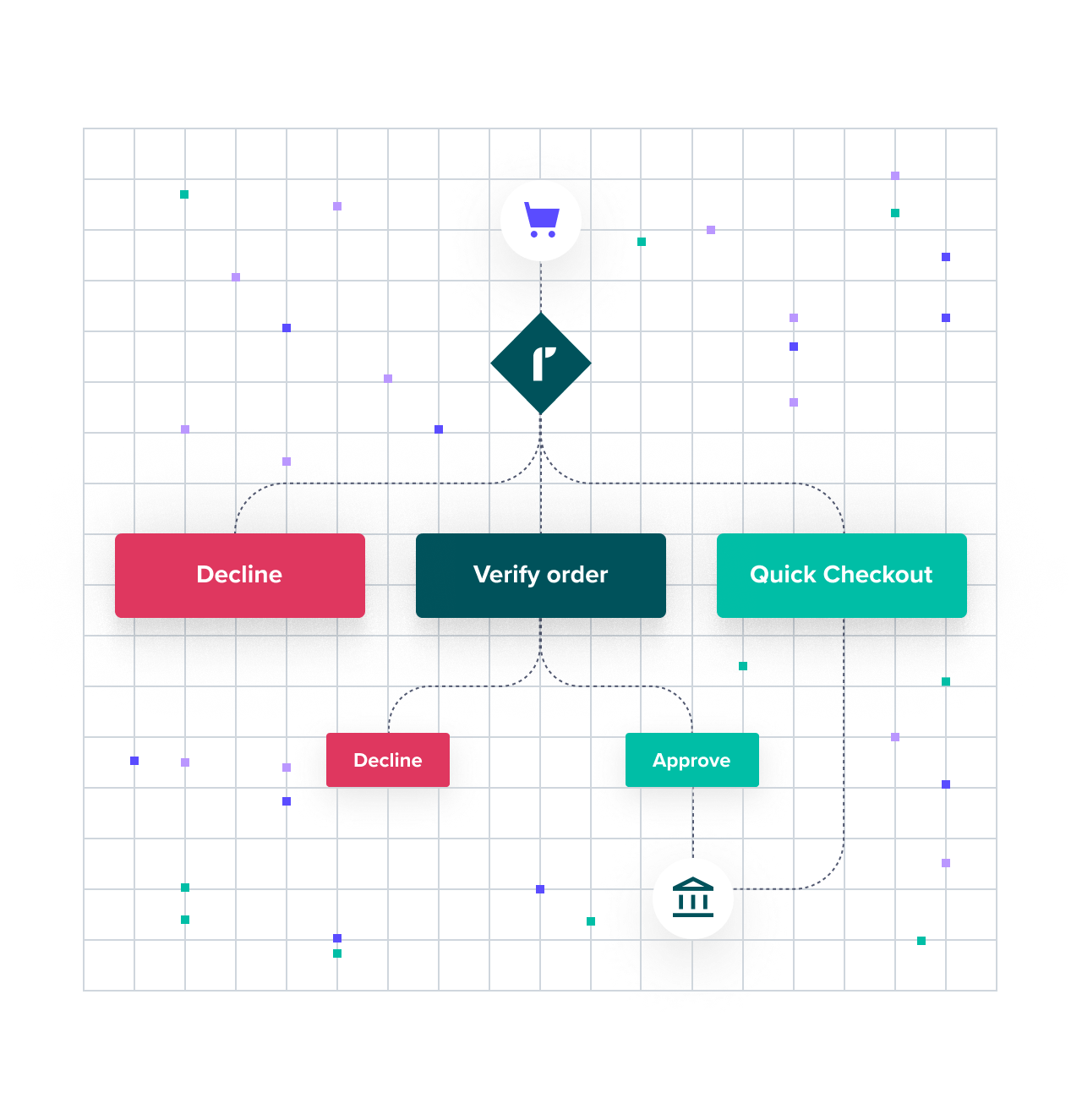

Yes/No fraud decisions might block bad transactions, but can still leave too many good customers behind. Adaptive Checkout is the first AI engine of its kind to dynamically identify good customers – not just risk. It intelligently segments each order to send good customers straight through checkout and authorization, screens out fraud, and identifies where and when to request additional verification in order to prevent false declines.

Boost authorization rates

Clean up your orders from obvious fraud before they reach the issuer, and send enriched order data to issuing banks so they trust your customers as much as you do.

- Data enrichment for partnering issuers

- Leverage pre-auth fraud analysis

- Reduce PSP costs

Win more customer satisfaction and loyalty

1 in 3 customers won’t return after a false decline. Turn legitimate but risky orders into approved transactions. Protect your customer’s lifetime value by getting every good order approved and authorized.

- 22% of U.S. shoppers drop off due to long or complicated checkout

- 1 in 3 customers won’t return after a false decline

Intelligent fraud protection and conversion optimization, in one

Block blatant fraud upstream of authorization

Riskified’s anti-fraud platform analyzes every transaction based on the order’s risk level, the identity’s shopping history, and millions of touchpoints across Riskified’s merchant network. Eliminate the cost of issuer checks for fraudulent orders.

Multiple choice checkout

Each order is directed through a specific checkout flow based on its risk profile. Your best customers go straight to checkout; potential ATO orders can be identified by providing CCV; risky but legit orders can be approved via one-time password, SMS verification or routing to 3DS.

Full visibility and control

Take charge of conversion across every step of checkout and the payments process. Understand everything about each shopper’s identity, get a granular risk analysis of every order, and view the reasons behind every approved or declined order.

Convert more good orders

Speak to an expert about how to increase approval rates with intelligent, adaptive checkout flows.

Request demoLet’s explore how Riskified can work for you

Goodbye false declines. Hello, converted customers.

What is Adaptive Checkout?

Adaptive Checkout is an advanced configuration of our anti-fraud platform, designed to reduce false declines and increase issuer authorization rates by giving your legitimate customers every opportunity to safely check out.

How does Adaptive Checkout work?

Adaptive Checkout uses machine learning to filter out obvious fraud, send your best orders straight to checkout, and safely increase approval rates by requesting extra information for statistically risky orders. Powered by our proprietary engine that automatically detects fraud patterns by linking billions of accounts, behaviors, and transactions across our global merchant network, the solution enables merchants to increase issuer approval rates and reduce false declines without opening themselves to risk.

What is selective verification?

Many merchants always request additional information – for example, asking for CVV every time a shopper checks out, even returning customers. Adaptive checkout utilizes AI to identify exactly when additional verification is necessary to differentiate between legitimate orders and fraud, keeping your business safe while speeding good orders through checkout.

How do you help with issuer authorization?

Adaptive checkout uses AI to identify and decline obvious fraud prior to sending it to the issuer. This both eliminates the transaction fees for these fraudulent orders, and over time causes issuers to trust orders from the merchant more. Riskified also partners with issuers, sending enriched order data so Issuers can more easily identify and approve legitimate orders. The result? They trust your good customers as much as you do.

Does Riskified use 3DS?

3DS is one possible form of identity verification, and utilized along with CVV check, OTP prompt and others. Adaptive Checkout also routes orders to 3DS in regulated markets, for example as part of PSD2.