Six questions for Paul van Alfen: Navigating airline payment fraud with a preeminent expert

The travel and hospitality industries swelled post-pandemic, driven by “revenge travel,” Taylor Swift concerts, or both. But with the surge of demand for travel came an inevitable surge in fraud, with bad actors targeting everything from loyalty accounts to illicit booking offerings and more. We chatted with Paul van Alfen, Managing Director of Up in the Air, and one of the most influential voices in travel payment strategies. With 20 years of hands-on experience, Paul is uniquely positioned to assess trends and to challenge payment and vertical strategies across the travel payments value chain. In this Q&A, Paul shares his take on current challenges and opportunities for airlines and other travel companies to navigate such a turbulent growth landscape.

- What are some common misconceptions about managing payments fraud in the airline industry?

[PvA] A common misconception is that fraud management is a stand-alone function in the back office; it should be an integrated part of the wider payment operation of an airline, included in a holistic strategy.

- How do you think the challenges faced by airlines have changed in the last 5 years?

[PvA] During the pandemic, no sales meant no fraud. With travel now fully back volumes at or above 2019 levels, airlines staffing levels (and skills) are not yet fully restored, resulting in the backlog in maintenance and innovation in fraud solutions not being cleared yet.

- What are some challenges airlines face when implementing new payment solutions? How do they overcome these challenges?

[PvA] Airlines are still struggling to keep up with the fast diversifying payment landscape. Especially because of all the mandatory maintenance on ‘hygiene factors’ like regulations, risk, compliance and data security. Switching to orchestration to support a multi-vendor strategy, either in-house or via a partner, is a possible solution to speed up the time to market of new products and services.

- What are some important indicators that airlines should monitor to ensure their fraud prevention measures are effective?

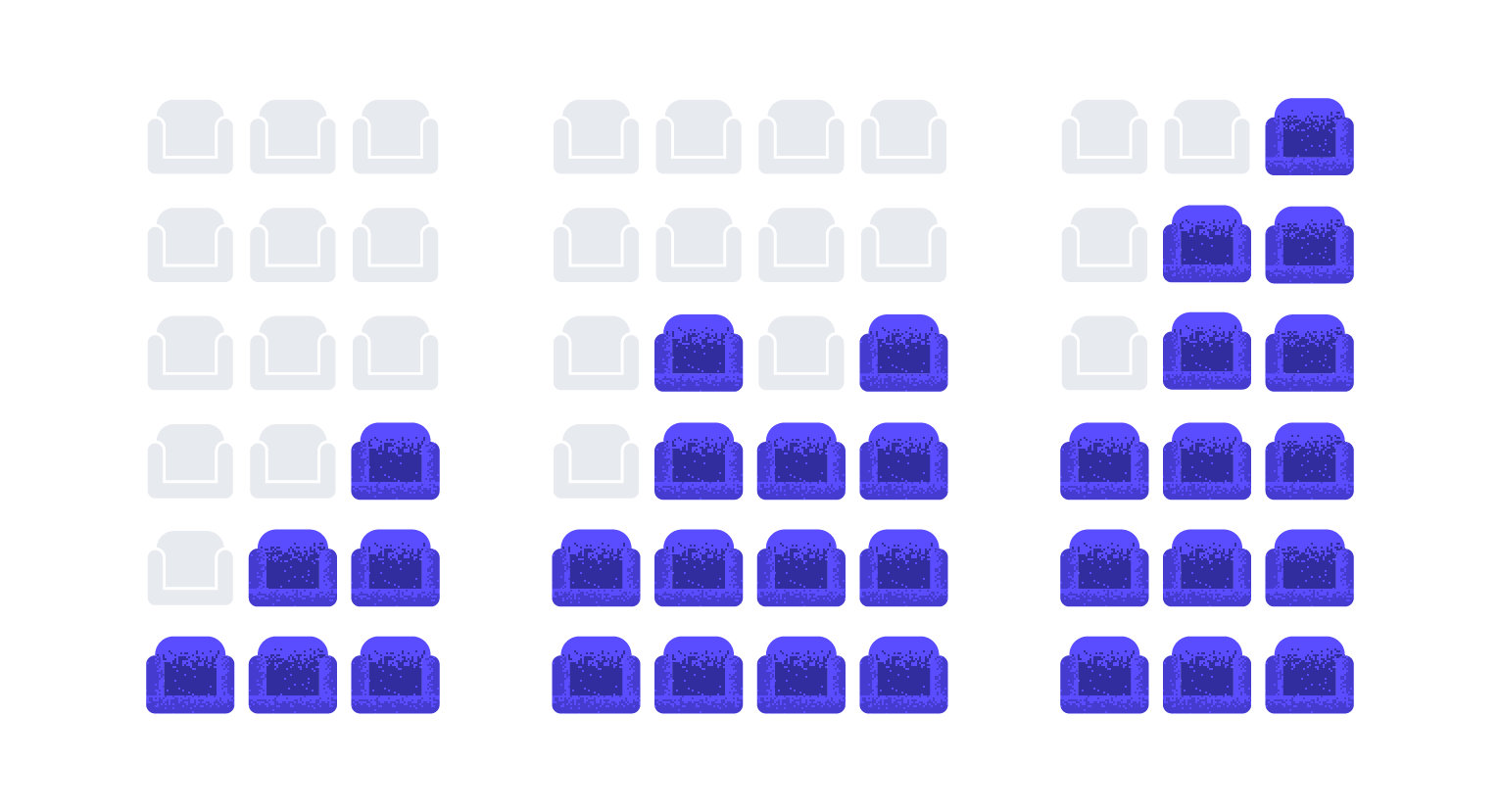

[PvA] Airlines should closely monitor their check out funnel, which includes the fraud screening step. See my infographic below.

- What is a common pitfall for airlines that have outdated fraud prevention methods in place?

[PvA] I remember a case where the manual review window was set at 36 hours, but because of insufficient resources for timely processing, tickets were automatically issued resulting in a massive amount of chargebacks..

- What do you think the airline industry should be aware of today to prepare for future payments fraud challenges?

[PvA] Try to identify the weakest link(s), resulting from the introduction of regulations (e.g. SCA) or new technology like AI. Also, keep an eye on alternative payment methods like peer-to-peer products, as well as your loyalty program which can be at risk for account takeovers.

Ready to dive deeper into the world of airline payment fraud and risk management? Join us for an exclusive webinar with Paul van Alfen as he shares more of his expert insights on strategies to navigate the airline fraud industry. Register now to secure your spot and get exclusive insights on October 1, 2024 at 10am ET.