Avoid Entering a Chargeback Monitoring Program This Travel Season: Data Reveals Risk Periods

Airlines have plenty of reason to celebrate this summer — travel continues to rebound, including a record-setting Memorial Day weekend in the United States. Riskified data confirms the trend, showing an overall 40% year-on-year growth in travel transaction volume for the first quarter of 2023.

Fraud, however, has also bounced back, largely tracking the increase in travel activity. What’s more, the data reveals more professional and sophisticated fraud schemes that are hard to detect locally, scale rapidly, and metastasize quickly across merchants and regions.

Account takeovers (ATOs) can be a real threat to loyalty programs, for example, by emptying accounts of the points or miles customers have earned. “Friendly” fraudulent chargebacks can also be an issue. It’s tricky but important for airlines to differentiate between chargebacks caused by fraud rings and those filed by otherwise honest travelers who use chargebacks to get a ticket refunded when they can’t or no longer want to travel.

On top of these concerns, the distinctive seasonal patterns of summer travel can create unique chargeback headaches for airlines and added risk of exceeding card issuer thresholds.

Latency Creates a Perfect Summer Storm of Risk for Airlines

Latency is always part of the chargeback equation, but it’s even more complicated for airlines.

First, there’s the usual lag between when a fraudulent transaction takes place and when the chargeback is submitted to the merchant — the average time gap between a submitted order and its chargeback submission is 34 days.

For airlines, you also see a lag between when travelers book and when they actually fly. That lag changes seasonally, as consumers book last-minute for some travel periods and plan ahead for others. FInally, some card issuers use an offset in the formulas to calculate chargeback rates. The offset can pair high fraud volume committed in, say, January to low transaction volumes tallied in June.

Depending on when and on how a card issuer calculates merchant chargeback rates, these variables can make predicting risk and avoiding monitoring programs very challenging for airlines.

Riskified recently conducted an analysis of these factors to help our airline clients project risk and volume in the summer months and assess their risk of entering card scheme programs.

High Chargebacks + Low Current Bookings = A Problem for Airlines

Certain card fraud programs calculate fraud rates (chargebacks per transaction) by submission date instead of booking date. In other words, if chargebacks from a busy booking month are submitted during a slow month for transactions, the ratio will look artificially high — high enough to put the airline into a card’s monitoring program.

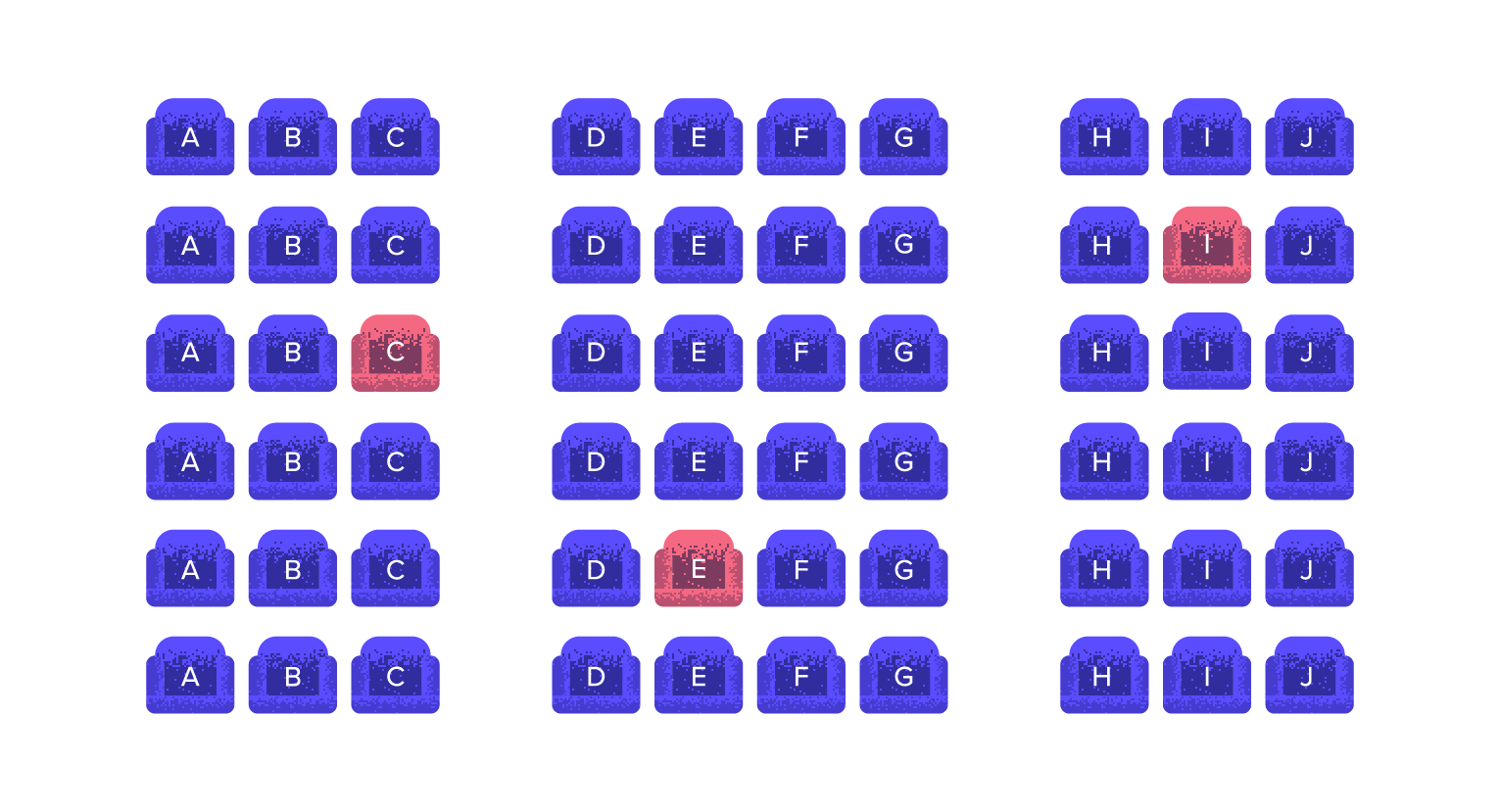

Based on Riskified flights data from 2022, July and August are the months with the highest potential to increase the chargeback rate calculated by card issuers and therefore the most risky for airlines from a threshold perspective.

Riskified’s analysis also revealed:

- For 2022 into 2023, based on the actual flight date, flight volumes were highest in the summer months (July -August), following December holiday season peak. When looking at flight tickets purchase dates the peak trends are different and also changes between regions. Thus we find the peak for US flight purchase was in Q2 while for APAC Q4 has experienced the highest volume.In addition, the highest share of transactions for flights more than six months ahead took place in January, indicating consumers purchase their summer flights well in advance.

- July and August are the months with the highest potential to inflate the chargeback rate calculated by card companies because submitted chargebacks are relatively high but current orders are relatively low.

- For U.S. airlines specifically, August exhibits the highest risk for an airline to enter a Visa or Mastercard fraud program.

In other parts of the world, this same pattern of travel latency and low summer booking elevated the summer risk of entering a card program. In Europe, July was the month with the most risk of entering a card fraud program. In the Middle East, it was September, and in APAC, August and September were the months with the highest risk of card fraud rate, which can end up with entry into a fraud program.

How Airlines Can Manage Summer Hotspots and Stay Out of Chargeback Monitoring Programs

The best way for airlines to reduce the risk of incurring excessive summer chargeback rates and monitoring is to accurately control chargebacks throughout the year and generate accurate “approve” or “decline” decisions in the moment.

Airline fraud teams may struggle to identify and prevent chargeback fraud before a transaction takes place, making those without sophisticated protection more vulnerable. Having an end-to-end chargeback management system is critical to keep pace with fraud and traveler expectations. It’s especially vital to have in place accurate pre-authorization and real-time fraud detection during busy booking periods when fraudsters launch major attacks.

And if you do get flagged for a card program this summer or any time? Riskified can help you get out quickly and stay out. Read about how Riskified helped Air Europa exit Visa’s excessive chargeback program and decrease its chargebacks by 95%.