COVID-19 and the Impact on eCommerce Shopping Trends

We’ve been closely monitoring our data in order to better understand how shifting consumer behavior is affecting eCommerce.

As the Coronavirus pandemic continues to spread, much of the world is adjusting to a new reality. And while it’s still too early to tell what the consequences will be for businesses, what is certain is that merchants need to adapt to the evolving situation. We’ve been closely monitoring our data in order to better understand how shifting consumer behavior is affecting eCommerce.

It comes down to necessity

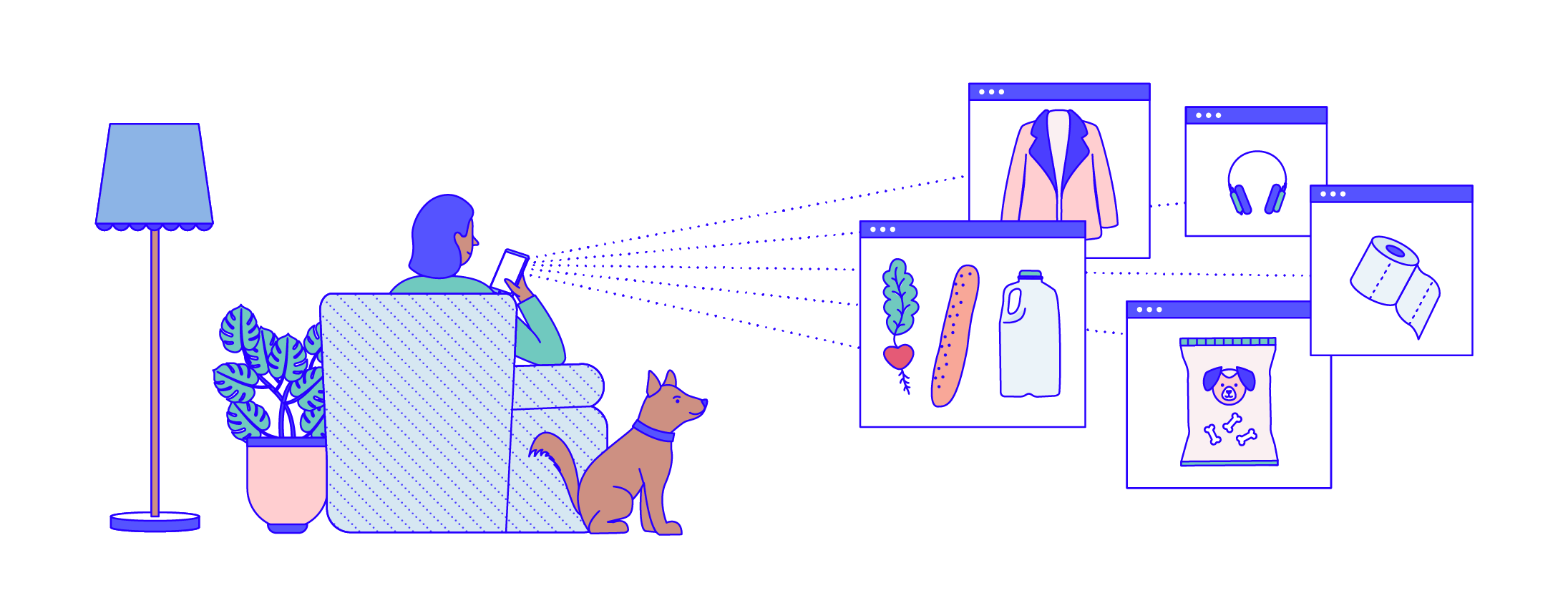

As shoppers avoid physical stores and more retailers close their doors, offline sales are taking a hit. But the outbreak won’t necessarily be doing favors for all online retailers. Consumers are turning increasingly to eCommerce, but they’re pulling back from buying non-essentials. In efforts to bring customers in, some retailers are offering generous discounts, free shipping and free returns. But even with promotions, consumers are holding back on discretionary shopping. Our data shows that while online sales for the fashion industry decreased by about 15% over the first 16 days in March, the high-end sub segment’s share was most significant, with a 40% drop in sales over the same period.

This decline is small in comparison to industries like travel and event tickets, who are among the hardest hit by the pandemic. Interestingly, prior to border and airport closures, there was a rush of people trying to get home. This led to a significant increase in last minute ticket purchases. In fact, the share of last minute orders in the beginning of March was 200% higher compared to March 2019. And to accommodate those who were subject to travel bans, hotels opened their doors. Our data reveals the proportion of orders with check-ins up to one day after the purchase grew by over 10% in the second week of March compared to the week prior.

On the other hand, some online businesses are thriving. The food industry is seeing a 66% rise in the total number of orders and a 75% increase in the total value, according to Riskified data. And that’s not just people making sure they’re well equipped for a long period of time. They’re also providing for their four-legged and other friends. We see the same sharp increase in pet food and supplies sales. This spike is understandable. As fear kicks in, anxious shoppers are stocking up on essentials. This also includes the home goods industry, like office supplies, sports equipment, and kids’ toys and games, which have seen a lift of 101% in total number of orders since the beginning of March. These kinds of products have all become in high demand with schools canceled, gyms closed, and employees working from home.

Geographical differences

Just like no one industry is being impacted in the same way, the effect of the outbreak on eCommerce is playing out differently across geographies. According to Morning Consult, Japan, the UK, and Germany were experiencing reduced confidence when the virus hit, while in the US, consumer confidence was near an all-time high. By March 20, consumer confidence hit a new two-year low in the US. In Japan, Germany, the UK and France confidence has continued to decline.

Although the fall in confidence is consistent with a bleak view of the economic future, eCommerce activity, particularly related to products consumers most need, is booming in the US. In fact, our data shows that the number of online orders from North America increased by 26% since the beginning of March. This growth is most likely a result of panic buying. President Trump urged Americans not to stockpile food and other goods, but this behavior may explain the uptick in sales. Meanwhile, from February to mid-March, France and the UK saw a decline in excess of 30%. Nevertheless, some UK retailers are finding ways to make up for the drop in sales. For example, Marks and Spencer has focused on building up their food business to take advantage of the rise in sales; they recently teamed up with Deliveroo to launch a new free delivery service.

In China, consumers have a more positive outlook. In fact, online sales in China seem to be picking up as the outbreak recedes. We see a spike in Chinese orders on March 8, when China reported no new transmitted cases outside the epicenter of Hubei province. Sales on this day increased a whopping 813% from the day prior, and continue to show steady growth since.

Although the rest of the world is not yet there, China provides a glimmer of hope to the potential rebound in sales once the effects of the epidemic subsides and consumers believe the worst is behind them.

Mobile apps on the rise

With major cities hunkering down to avoid the spread of the virus, people are inevitably spending more time indoors and on their mobile devices. They aren’t driving, holding face-to-face meetings, or engaging in many of the activities that normally require them to put away devices. During the outbreak in China, phone usage went up from 6.1 hours a day to 7.3. But most importantly, the increase in mobile use can be understood as a means of tackling social distancing. Apps in particular have played a major role in facilitating the transition from day-to-day life to lockdown.

In a time of stress and uncertainty, eCommerce brands are leveraging their mobile apps to offer a more convenient online experience. The result can be seen in the numbers. According to research from Apptopia, March 15 was a record for the average daily app downloads for Instacart, Walmart Grocery and Shipt. Instacart stated, “many new customers are signing up”, with daily downloads of its iPhone app increasing fourfold by mid March. Target also saw a 98% jump in average daily downloads. Our own data confirms this surge: mobile app sales jumped 71% from the 1st of March to the 16th of March for the food industry. Desktop orders on the other hand have seen a decline. In retail, where web orders usually represent the largest share, sales decreased by 15%.

In terms of fraud, attempts via desktop across a number of industries actually increased, but this can most likely be attributed to lower order volumes – while fraud did not grow, its share of desktop orders did. Interestingly, fraud attempts for mobile apps initially rose, but are now subsiding. And although mobile app orders are traditionally riskier, this change is most likely a result of this order source becoming more common and popular among good customers.

Major retailers like Walmart seemed to have been well-prepared for this mobile app preference, partnering with Apple to offer voice shopping with Siri back in November. But even before that, Walmart was amping up their digital efforts. Last year, they rolled out their grocery pickup program, attracting convenience-focused, digitally-savvy shoppers who value the online experience over in-store shopping. Now under social distancing measures and self-quarantining, shoppers don’t have the same luxury to choose between the two. But they do have a choice when it comes to how they buy online and strong mobile apps seem to be winning. Post-Coronavirus it will be interesting to see if consumers will come to rely on the online shopping apps they’ve discovered during this period.

Conclusion

Experts around the world have been trying to forecast what the aftermath will be of the Novel Coronavirus. It’s clear that it is changing consumer behavior, but the exact long-term consequences are still impossible to predict. We can only hope the effects will be temporary. By sharing some of our most recent findings and insights, we hope that we can help our merchants navigate through these trying times and best prepare to manage the rapidly evolving situation.

For any questions, please reach out via email to [email protected]