Debunking The Top 5 Misconceptions About The Chargeback Guarantee Model

The Chargeback Guarantee model of fraud prevention is preferred by large eCommerce businesses because it leads to consistently wide margins and fraud cost predictability. In our decade of operation, it has been the foundation of thousands of thriving, long-term partnerships. The strength of the model is one reason that each year, 99% of our merchant partners choose to renew their relationship with us. Still, some providers in the fraud prevention space do their best to cast doubt about the model’s many benefits. In this article, we will address the five most pervasive pieces of misinformation circulating about the chargeback guarantee model.

Misconception #1: “The chargeback guarantee model is just a liability shift.”

The first most common misconception about the chargeback guarantee model is that it’s just a liability shift for chargebacks. In practice, shifting chargeback liability has massive implications for the partnership: a guarantee for a higher approval rate, cost predictability, knowledge share and partnership, margin optimization, and, yes, also a liability shift. All of these add up to a lift in revenue. Riskified pioneered this model in 2013, and it is still the business model we use for fraud prevention because it’s what the largest online merchants ask for.

As part of the chargeback guarantee model, providers deliver real-time approve/decline decisions on incoming transactions and assume liability in cases where approved transactions turn out to be fraudulent. For the provider, this model only makes financial sense when coupled with outstanding decision accuracy, which is often achieved by training machine learning algorithms to analyze and infer from countless past transactions.

The reason accuracy is essential is that a provider won’t go far paying for costly fraudulent chargebacks which it approved in error, but the partnership won’t last if the provider is over-declining. At Riskified, we charge a fee for each order we approve, which incentivizes us to maximize approvals and keeps costs in line with your revenue.

Misconception #2: “The chargeback guarantee model is just a form of fraud insurance.”

The second misconception is that chargeback guarantee is just “fraud or chargeback insurance.” Those claiming so are missing the point. Insurance is bought against potential risk. Fraud, on the other hand, is a certainty. Fraud will happen, today, tomorrow, and the day after. In other words, the eventuality of fraud suggests that insuring against it cannot be a sustainable model.

Under the model, the product is accurate approve/decline decisions, coupled with the offloading of inescapable chargeback costs. Beyond the clear advantage of cost predictability, the guarantee we offer is also a testament to our confidence in our decisions. Fraud prevention providers who do not guarantee their decisions are not accountable, and their lack of accountability means they have no real consequences for performance misses.

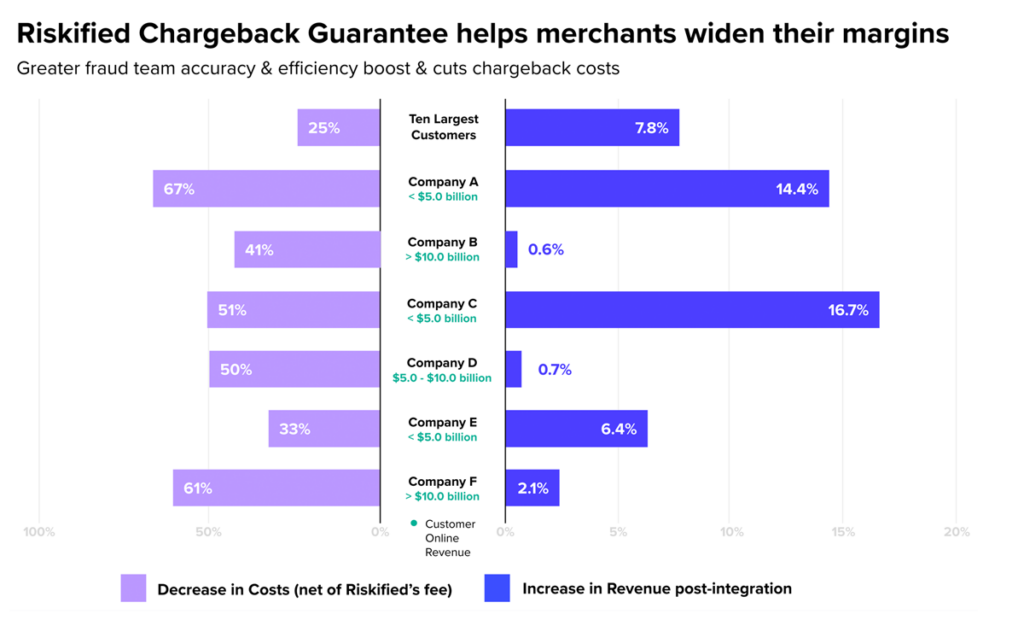

Rather than thinking about chargeback guarantee as a model that eliminates the financial risk of chargebacks for the merchant, its primary value is in boosting approvals while eliminating chargeback risk. In recent years, our top 10 merchants saw an average revenue lift of 8%, coupled with a 25% reduction in fraud-related costs.

Misconception #3: “The chargeback guarantee model leads to more risk-averseness than other fraud solutions.”

As a merchant, you may fear that a chargeback guarantee provider might be more risk-averse than other fraud solution providers. But reducing chargebacks by simply avoiding risk cannot sustain partnerships and lead to success. For one, our merchant partners’ expert fraud teams won’t work with a solution provider who’s leaving good orders on the table.

The challenge here, as in most things in life, is hitting the right balance. For us, this means a practice of working with our partners to push approval rates to the limit, while putting the best technology and the best human minds on the case constantly scanning for anomalies.

Here’s the differentiator: We are able to block more fraud while approving more good orders because we see more of the big picture of fraud.

We built the largest fraud analysis team in the industry and leverage knowledge based on rich history and the widest-cast network of merchants. Our decision engine is powered by best-in-class ML models and over 2.5 billion past orders, enabling us to be more accurate in our detection of fraud. When we partner with merchants, we work together with their in-house fraud teams to build on their unique expertise and experience and help them excel. Through such partnerships, merchants maximize their revenue potential.

So why do we stick to the chargeback guarantee model? Because there is no such thing as 100% fraud-proof, and even our best-in-class solution isn’t perfect. Occasionally, we make (very costly) mistakes. That’s where the shift of liability makes an impact.

Misconception #4: “The chargeback guarantee model offers value only to merchants with high-risk segments.”

Chargeback guarantee is the model best suited to the way fraud evolves. The maddening thing about fraud is that despite ongoing investment in fraud prevention technologies (and some of the best tech minds on the case), fraudsters often manage to stay a step ahead. Fraud is incredibly complex and constantly changing. Dark web and fraud pattern research show how adept fraudsters are at finding vulnerabilities and maximizing each opportunity. Using bots and other off-the-shelf tools, they play a numbers game, constantly A/B testing new MOs and loopholes and working them until they’re blocked.

Seeing how fraud attacks happen, especially orchestrated efforts by criminal fraud rings, it’s clear these fraud incidents don’t gradually unfold, but rather spontaneously combust. Failing to intercept fraud activity can lead to tens of thousands of dollars in chargebacks in mere hours.

Here is another truth about fraud: it’s worthwhile. All of it, from $2 socks to $2000 laptops. That’s because the technology of fraud has made it incredibly cheap and scalable. Some fraud solution providers like to distinguish between ‘safe’ and ‘risky’ segments; experience shows us that no product category, payment method, or shipping location is off the hook. Some sophisticated fraudsters take advantage of the concept of “safe segments,” coupling benign items such as socks with more costly goods such as high-value gift cards to add a veneer of respectability to their orders and optimize for success.

In recent years, Riskified’s analysts have intercepted multiple fraud rings targeting low-cost, presumably safe goods such as lip balm and baby gear. One fraud ring intercepted by our analysts racked up tens of thousands of dollars in fraudulent purchases of… coffee pods. Unexpected fraudulent behaviors such as these illustrate the crucial role human experience and expertise play in fraud prevention.

Misconception #5: “The chargeback guarantee model is no different than other fraud prevention solutions with advanced machine learning engines.”

The fraud prevention industry has matured significantly since we pioneered this model, and machine learning-powered decisions are fast becoming an industry standard. While ML is an incredibly powerful tool in the war on fraud, we know there is no real substitute for human expertise. Some fraud solution providers boast that they depend exclusively on machines. In the process of developing the best response to fraud, we invest heavily in building the best team of fraud and data analysts.

Chargeback Guarantee is the framework we found best delivers consistently accurate decisions and maximizes approvals on good orders. We routinely take the lead in terms of investment in research and development. This means that our team is the largest in the business, our ML models are the most accurate, and we cast the broadest, most comprehensive fraud knowledge net. We’ve gotten as close as any company has to solving the problem of fraud, but, as is its nature, fraud persists, remaining just a step ahead. Ecommerce is a team sport, and excelling online means assembling the right team of best-in-class players. Think of us as your offensive line.

Get your copy of the Gartner Market Guide for Online Fraud Detection to learn more about the critical considerations for assessing your business’s specific requirements and must-have capabilities for mitigating high-risk events along the digital customer journey.