Giving in the Digital Era: How Gift Cards Build eCommerce Resilience

Demand for gift cards is surging right now, courtesy of COVID-19. Alongside tremendous growth opportunities, the industry is rife with risk.

Gift cards, especially the digital variety, do not have an excellent reputation. While some consumers consider them a rather lazy form of gift-giving, merchants note that at their worst, digital gift cards are a dubious commodity that practically invites fraudulent activity.

But this is a different world we live in now, and in this digital-first era, gift cards can become a powerful engine of growth. Months into the global COVID-19 crisis, digital interactions and eCommerce stepped in to fill the void created by lockdowns and social distancing policies. As global commerce moved online, merchants who adopted a higher level of digital fluency were the fastest to bounce back. Ecommerce businesses recorded an increase in new customers since the beginning of the pandemic, and our data show a significant surge in gift card sales, alongside other verticals such as electronics and home goods.

Global gift card sales recorded a steady rise in recent years. Allied Market Research valued the market at $619.25 billion in 2019, and projected it would reach $1,922.87 billion by 2027. Beyond generating revenue at their specified monetary value, gift cards incentivize secondary spending. In a March survey by eMarketer, 69% of US-based online shoppers said gift cards would entice them to buy more.

Since the beginning of the pandemic, the often-downplayed gift card has been repainted as a hero. Many businesses, hit by the changing economy, began selling gift cards in an effort to broaden their digital offerings, increase revenues, or simply stay afloat. Serving as small, instant digital loans, gift cards empower customers to enjoy and support their favorite businesses. In April, eCommerce marketplace Shopify made its gift card feature available to all its merchants to support them through challenging times.

Consumers are embracing the trend. Blackhawk Network, an eGift marketplace, recently recorded a 44% increase in gift card sales year-over-year. A survey they conducted found that more than a third of respondents (38%) have been using gift cards for charitable actions during the crisis. And the shift in attitude towards gift cards will likely extend beyond the upcoming weeks and months, as 70% of respondents said they will look for creative ways to give gifts on upcoming holidays, including Mother’s Day, Father’s Day, graduations, and weddings this year. Earlier this month, on Mother’s Day, people in the US spent more on gift cards than they did on flowers and spa days.

What people like about gift cards is the convenience and immediacy of a gift that is bought, delivered, and spent online. It makes sense. Between the abrupt increase in eCommerce activity and expected production delays and inventory shortages brought on by Coronavirus, gift cards offer a dependable alternative.

There is, of course, a fly in the ointment. The thing about gift cards is that the very features that make them so attractive right now also make them irresistible to fraudsters. They are fulfilled instantly, leaving a very short response time and rendering manual review unsuitable. The fact that they are bought and dispatched digitally means that fraudsters do not have to contend with what is perhaps the trickiest part of their fraud journey: address verification and delivery.

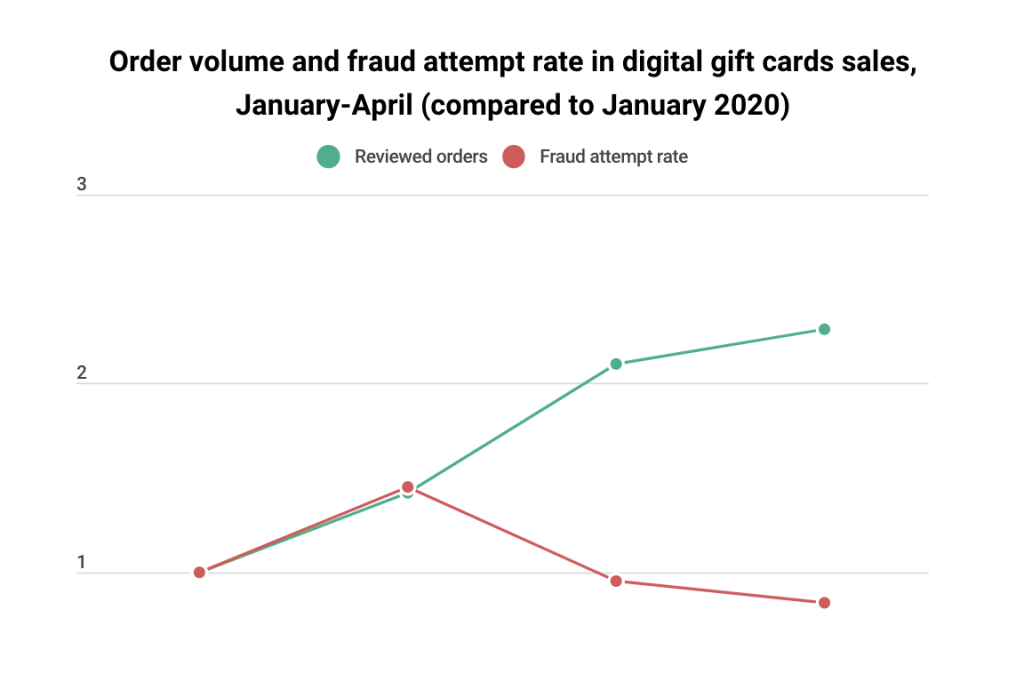

Moreover, most professional fraudsters are after cash in hand, and the resale value of stolen goods is often the key factor determining the merchandise they target. Gift cards are as good as digital cash, which means they are easier for fraudsters to use and trade. It’s well known that selling gift cards carries more risk than selling physical goods. Between January and April, the number of gift card orders reviewed by Riskified more than doubled. Fraud rates also rose initially, but declined later on; we recorded a 45% spike in the rate of fraud attempts between January to February, but by April fraud figures dropped below January levels. These figures speak to the challenges of this industry, but even more so to its surging popularity. Since most fraud solutions are designed to be cautious of new behaviors and dramatic activity spikes, a sudden uptick in gift card orders could lead many merchants to falsely decline many good orders.

With growing consumer demand for gift cards, merchants should explore technology-driven, safe ways to expand their digital offerings. Partnering with a fraud detection solution with strong digital detection capabilities and the capacity to adapt to changing consumer behaviors can mitigate the risk associated with digital gift card sales and allow merchants to bank on this trend without taking unnecessary chances.

Key takeaways:

- Demand for gift cards is skyrocketing

- For merchants, gift cards are an important vehicle of growth during economic uncertainty

- Unlike traditional goods, gift cards come with their own unique fraud patterns and challenges

- To protect themselves, merchants must understand gift card fraud, and find a way to manage risk without stifling growth