Not OK, Boomer: Dangers Loom as Baby Boomers Flock to eCommerce

There used to be two types of people in this world: those who preferred the convenience and infinite selection of online shopping; and those who liked to “feel the material.”

When COVID-19 forced us away from public spaces, eCommerce became a lifeline. Many baby boomers, previously steadfast in their preference for the in-store experience, had to quickly adapt to safely procure groceries and other necessities.

As social isolation lingered, boomers grew more comfortable with online shopping. Now, having acquired the skill, it is likely that many of them will continue to shop online even after the pandemic is over. For merchants, this spells tremendous opportunity. Boomers are one of the wealthiest generations, and savvy merchants can come out of this habit-forming period with a trove of new lifetime customers. But there are new risks, too, as boomers are disproportionately victimized by online fraud.

Boomers can move the online economy a step forward, but also two steps back

Boomers, loosely defined as people born from 1946 to 1964, have long been considered above-average earners and spenders. Most of them came into the pandemic better off financially, with steadier jobs, more savings, and more property. As many people in their early and mid-career are facing several lean years, boomers are expected to be less affected by current changes to the job market. A considerable buying force, boomers can help see the economy through this crisis, as long as their digital experiences are seamless and safe. This is the tricky part.

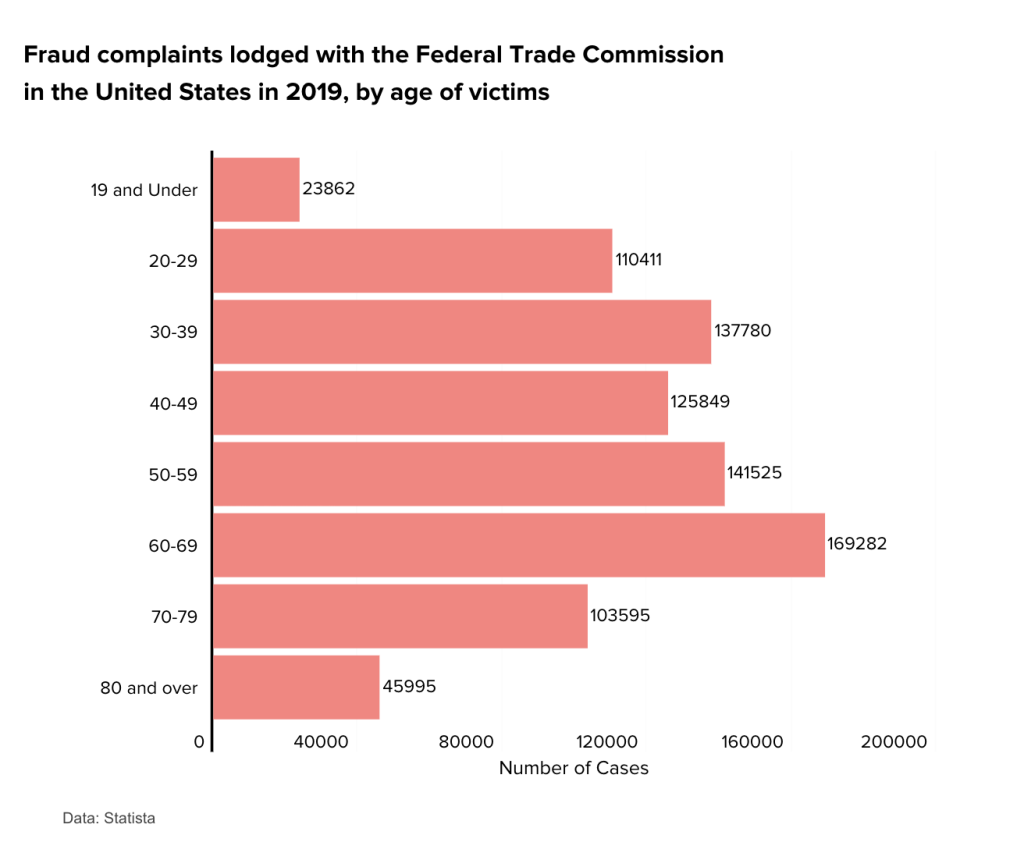

Baby boomers are more vulnerable to online fraud. The more they shop online, the more exposed they are, risking their own pockets as well as merchants’ reputations and bottom lines. One of the reasons for this is that older shoppers tend to be digitally naive, and therefore more vulnerable to scams that can result in fraud. It is a Chicken or the egg situation, in which fraudsters target people between ages 60-69 with various phishing scams, reinforcing the bias.

Beyond personal damages to consumers, these attacks can cause serious damages to merchants in the form of chargebacks, account breaches, lost lifetime value, and inclusion in fraud monitoring programs.

COVID-19 has only exacerbated online fraud’s ageism problem, making older adults more susceptible to financial and online fraud. This is due to increased exposure online, yes, but also to the psychological effects of the pandemic. Loneliness and isolation make potential victims more eager to communicate. It can diminish their ability to think critically about online interactions and expose them to social manipulation and phishing scams. Additionally, the last few months gave rise to a host of pandemic-related scams, with fraudsters pretending to be with the CDC, the World Health Organization, or other official agencies, manipulating victims into providing identifiable information such as social security numbers and login details.

In these uncertain times, online merchants are handed a golden opportunity to tap into a new market segment. If they fail to provide boomers a safe shopping environment, this big step forward could lead to two steps back. So how can merchants capitalize on the new business, ensure high approval rates AND protect the safety of these new shoppers?

Balancing opportunity and risk

Technology can help fortify a merchant’s defense where the shopper’s vulnerability play a role. It can detect suspicious online buying patterns and intercept bad actors even before legitimate shoppers realize they had been defrauded. But when a fraud solution is too rigid, many good orders are left on the table. This is especially true for rule-based fraud prevention, which often does not account for changes in shopping patterns.

Merchants’ Catch-22 is that a boost to business can often be mistaken for fraud. Unrecognized customers and new shopping behaviors overwhelm most fraud management systems, leading to an increase in false declines. When it comes to boomers, this is especially painful, not just for their superior buying power, but for their potential lifetime value.

Merchants know that the time to establish brand loyalty is now. A seamless experience from browse to checkout can help guarantee customer satisfaction, while a falsely declined transaction could send a lucrative new customer straight to the competitor. This is why it is crucial that merchants ensure their fraud prevention systems are agile enough to safely approve as many good orders as possible during this critical time.

Merchants can also cater and appeal to new customers by providing information and support. Many eCommerce websites employ written instructions, chat assistance, and customer service to help shoppers distinguish legitimate online processes from fraudulent practices. For example, merchants want new customers to create a store account, as account holding customers are proven to shop more frequently and spend more per purchase. By communicating the risks of credential phishing attacks and data breaches, merchants can educate new customers on safety measures they can take to protect their accounts.

The right fraud prevention solution can also cover up for any vulnerability and ensure merchants’ sites are hospitable and safe for new boomer shoppers. The trick is to find a solution that is not so stringent as to block legitimate and valuable orders during periods of rapid change. Infinitely more adaptable than rule-based systems—and more scalable than manual fraud operations—machine learning fraud prevention technologies accommodate changing consumer behaviors to keep merchants and shoppers safe. Utilizing a vast network of data, Riskified’s ML-based fraud solution can intercept and block bad actors as early as the login point, deliver instant and accurate approve/decline decisions, and lead shoppers safely to purchase.