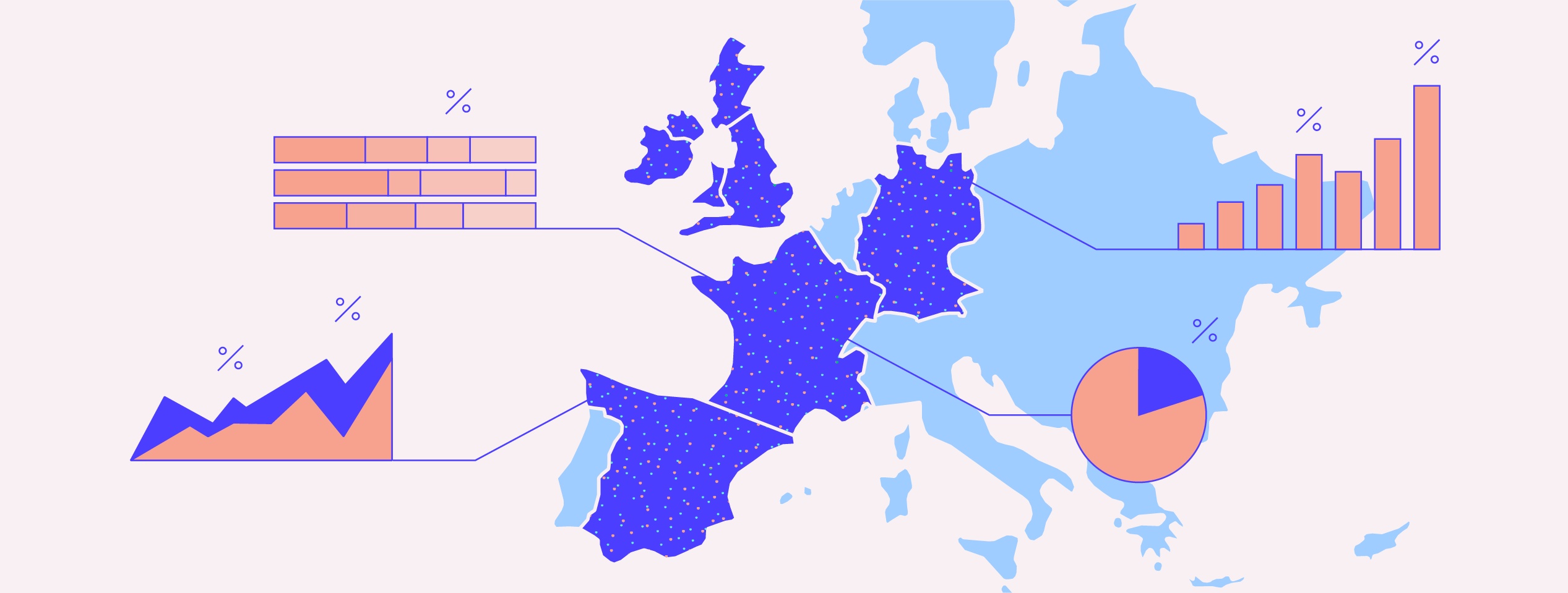

Infographic: What Europe really thinks about PSD2

PSD2 has led to a period of uncertainty for online merchants and consumers alike. To find out more about their concerns, Riskified commissioned a survey in 2019 of 2,000 consumers and 200 retailers evenly split across the UK, Germany, France, and Spain.

Elena Lerman, one of our talented in-house designers, has turned the results into an engaging visual. Her infographic reveals retailers’ views regarding PSD2, specifically whether their plans are sufficient given online shoppers’ responses to the increased security measures.

Note: In questions where survey participants could select more than one answer, total responses may amount to over 100%.

How often do you shop online?

Over 40% of European consumers shop online at least once a week, while a third do so monthly. Of the markets surveyed, consumers in the UK report shopping online most frequently.

If you were asked to verify your identity* when shopping online, what action would you take?

*e.g. via PIN number, SMS, knowledge-based questions, ID card or device evidenced through QR code

A third of shoppers would leave a site/app when asked to verify their identity. Interestingly, 56% of French shoppers would be willing to provide this information, but consumers from this country are less likely to use alternative payment methods.

What impact do you think PSD2 will have on online shopping?

The survey reveals that nearly one quarter of European consumers expect PSD2 to make online shopping more difficult.

What impact do you expect PSD2 to have on your cart abandonment rates in the first 1-2 years of implementation?

80% of European retailers expect that PSD2 will negatively impact cart abandonment rates. Nearly 50% expect a significant increase (of 20% or more) in shopping cart abandonment rates.

Has your company taken steps to minimise the negative impact that PSD2 might have on revenue?

Over a third of retailers plan on using a third party solution to deal with the potential ramifications of PSD2. Only 13% of European retailers said they don’t believe PSD2 will have a negative impact on revenue.

Which of the following statements do you agree with?

Almost 40% of European merchants are pessimistic about PSD2’s ability to curb fraud. A quarter of these retailers even expect to experience an increase in fraud rates. Around 60% of online retailers anticipate the new measures will reduce fraud, but are aware of its drawbacks.

Which do you consider most when choosing where to make a purchase online?

After price, security is the top consideration for online shoppers. Given this, retailers serving European consumers should ensure they have sufficient measures to contain fraud and maintain their customers trust.

Would you continue shopping from a business where your online account was compromised?

Over half of European consumers (and 62% of Spanish shoppers) would never return to a business where their online account was compromised. Only 15% of respondents said it would not impact their shopping choices.

What percent of your fraud losses last year were due to Account Takeover attacks?

75% of European retailers incurred fraud losses due to ATO attacks last year. One in five merchants said these attacks accounted for over 40% of their fraud-related losses.

Protect your revenue under PSD2

PSD2 has many benefits, but merchants also need to be aware of its potential pitfalls – namely, customer friction and its limitations in preventing all types of CNP fraud. As the survey reveals, where a customer doesn’t feel that their credit card or account is secure, merchants will likely take a serious hit to their revenue and brand reputation.

Riskified’s PSD2 Optimization is the latest in our suite of AI-based products designed to provide merchants with holistic fraud prevention. To hear more about how it can help you comply with PSD2, while keeping legitimate customers moving along the path to purchase, contact us at [email protected].