Riskified’s 2021 Holiday Report: ‘Tis (Still) the Season to Be Jolly

Ecommerce is on the brink of yet another record-breaking holiday season, following 18 months of acceleration in online shopping. But the Golden Quarter poses its own share of challenges.

The holiday season is sometimes referred to as the most hectic time of the year — and that’s not taking pandemic repercussions into account. This year, retailers must think about rebalancing in-store and online channels, planning around supply chain disruptions, and offering the variety of shopping, payment, and fulfillment options that digital customers desire.

Riskified’s latest report aims to give online merchants the confidence to meet these challenges head-on without opening themselves up to additional risks. In this post, we provide a preview of some of the insights that appear in the full report.

Customers will seek digital gift cards due to product shortages

Looking back on the 2020 holiday season, the industries that experienced the biggest growth in sales were food and beverages, health and fitness, and home improvement. Big retail continued to be the most popular consumer category during the holidays, snagging over 50% of the market share. Apparel, footwear, and electronics made up another fifth of all eCommerce sales.

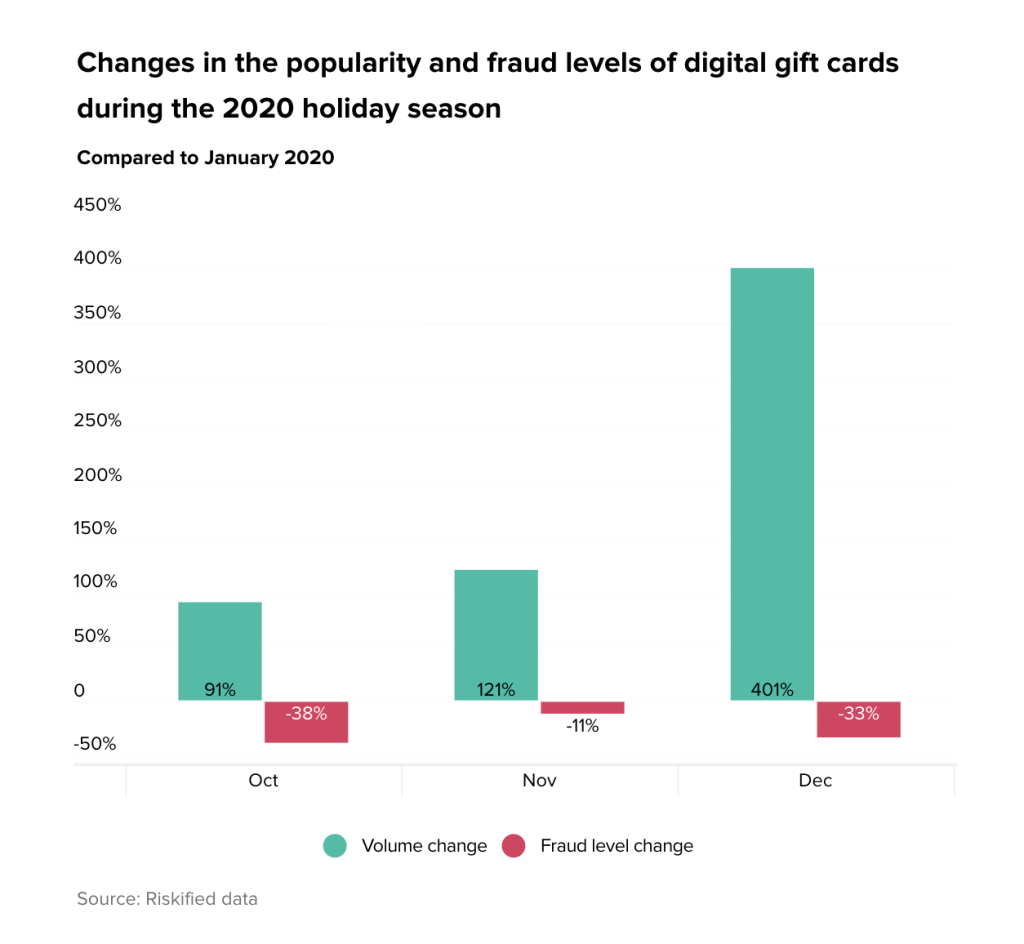

The global supply chain crisis is still causing substantial inventory shortages of physical goods. In December 2020, the demand for gift cards increased fivefold compared to January of that year, while fraud levels dropped by one-third. This year, we expect worried consumers to continue embracing digital gift cards as a way of ensuring the timely delivery of gifts. US consumers are expected to boost spending on them by 27% YoY to an average of about $270 per person.

While increasingly popular, most merchants still consider gift cards risky due to their digital fulfillment. Riskified has seen a significant decrease in the rate of fraud attempts, which may indicate that these orders are being over-declined as a result of risk averseness and reactive fraud analysis.

Bring customers in-store while leaving fraudsters out in the cold

Already a growing fulfillment preference, in-store pickup has seen widespread adoption since the start of the pandemic. The 2020 holiday season saw 43% of US shoppers choose Buy Online, Pick-Up In-Store (BOPIS), citing convenience and time-saving as their top reasons. More retailers are now diversifying their channels and enhancing their digital capabilities, allowing customers to move between touchpoints with greater ease. BOPIS provides them with the opportunity to collect the goods they ordered online quickly, without spending time in a store sifting through stocks or trying things on.

In terms of fraud, in-store fulfillment methods naturally carry a heightened risk: with no shipping address required, there’s less data available to corroborate a customer’s identity. Moreover, customer service agents fulfilling orders are expected to verify identity in real-time, but often aren’t trained to spot forged identifications and don’t have the time to thoroughly vet each shopper.

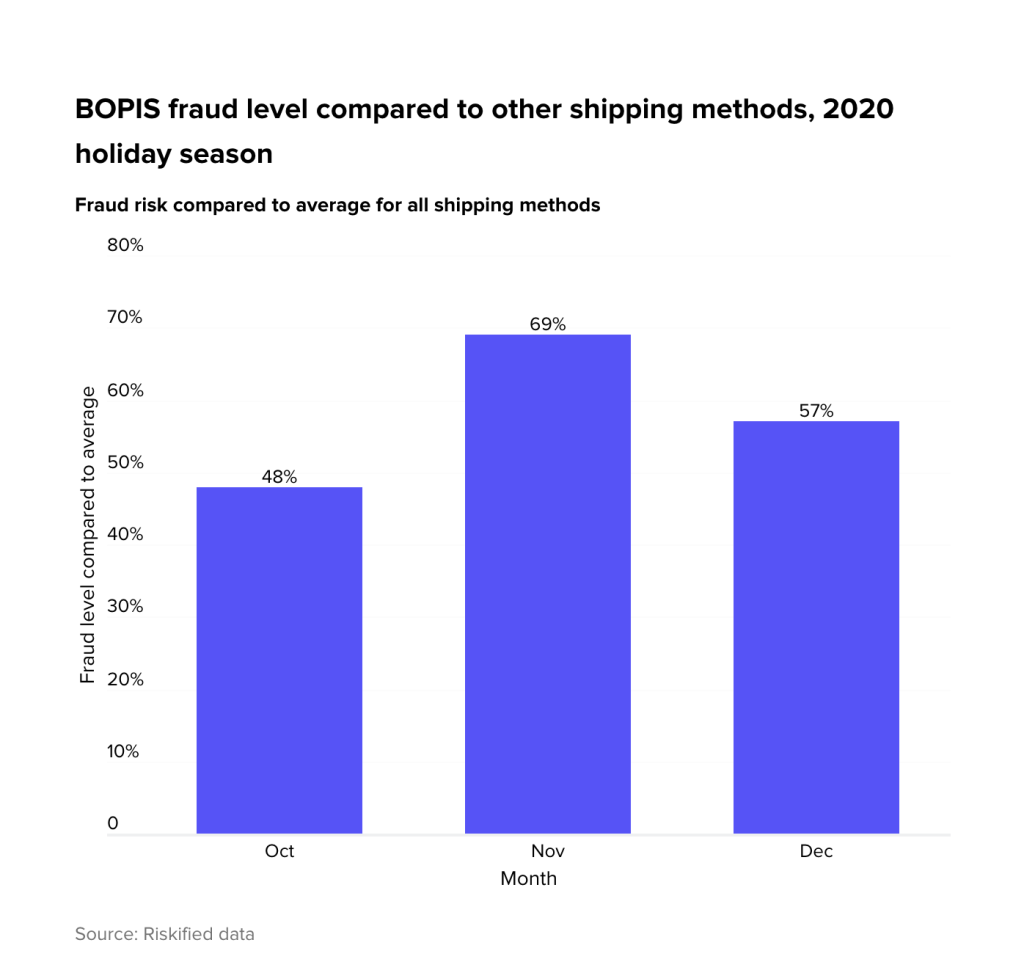

During the 2020 holiday season, BOPIS was a fraudster favorite. Compared to January of that year, by December there were over four times more fraud attempts through BOPIS orders. Its increased adoption by good customers, however, means the share of fraud attempts out of all BOPIS orders was twice as high as January. Compared to all other fulfillment methods, BOPIS was 50%-70% riskier than average during Q4 2020.

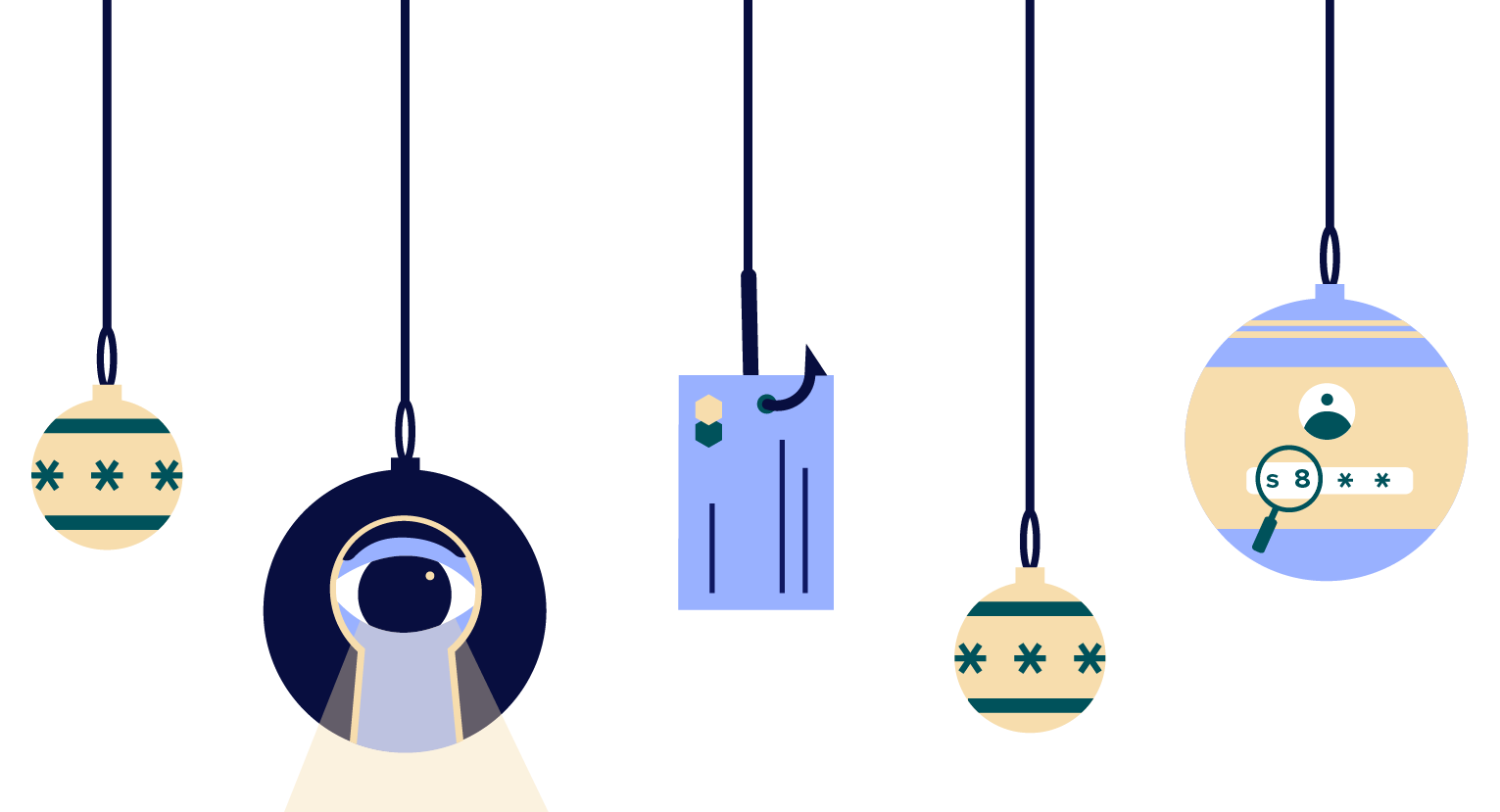

Promos: drive customer loyalty while avoiding abuse

More than a time to lift yearly revenues, many merchants today view the Golden Quarter as an opportunity to establish relationships with new buyers and convert them into returning customers. Merchants across all sectors offer lucrative promotions and exclusive discounts during the holidays. On top of the cost of customer acquisition, they absorb the losses associated with discounts based on precise ROI calculations, allowing them to reach a broad audience while remaining profitable. But often they’re left vulnerable to policy abuse: Fraudsters and other dishonest shoppers are known to open multiple store accounts to accrue discounts and store credit.

On a small scale, the fallout from this kind of abuse may be of small enough significance that it’s still worth the merchant’s while to offer these discounts and promotions. When resellers enter the picture, however, things look very different. These unofficial resellers purchase large quantities of stocks at discounted prices, often taking advantage of holiday promos, only to sell them for a profit. Not only can they liquidate a merchant’s stock, they can also directly compete with a merchant for customers.

With policy abuse, as opposed to Card-Not-Present fraud, it’s unclear where merchants should draw the line between good and bad, acceptable and exploitative customer behavior. To solve these challenges and set limits, merchants need to understand which of their customers use their policy, and how often. Once boundaries are clear and the true entity behind a customer’s identity is established, enforcement becomes possible.

Learn more and get six key takeaways in our full report

These are just a few of the topics covered in Riskified’s 2021 Holiday Season Report. For consumer trends and fraud insights on alternative payment methods, mobile shopping, customer accounts, and more, download your complimentary copy of the report.