The Coronavirus Effect: How Six eCommerce Markets Fared Dec-May

Online sales surpassed December 2019 figures across all geographies. More and more population segments are making the adjustment and shifting to online sales.

When we first analyzed the impact of COVID-19 on eCommerce, it was clear that consumers were behaving differently across geographies. We sought to gain insight on how fraud and shopping behavior shifted across six major markets by looking at data from December through April, to understand how eCommerce has fared as the pandemic drags on.

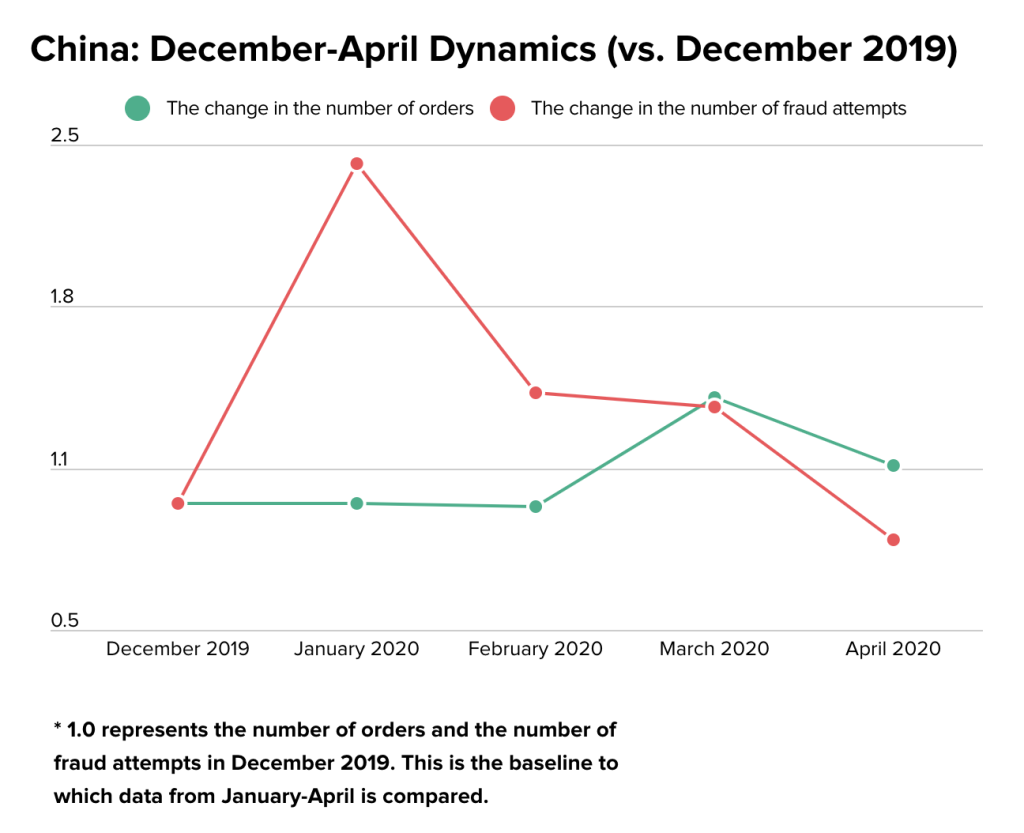

China

On March 30, the city of Wuhan reopened for business. An excited local shopper declared, “I want to revenge shop” and it’s this kind of sentiment that spoke to the growth in online sales in March. We saw that the average number of online orders almost doubled from February to March, so customers seemed to have been antsy to get back in the routine of things. But the streak of unparalleled growth tapered down in April.

The average daily number of sales decreased by 49% from March. The comeback shopping and excitement for a taste of normalcy slowly faded as businesses and consumers realized that the rest of the world will need to overcome the pandemic before the global economy gets back on its feet. Fraudsters were also more active in March; the fraud attempt rate at the end of March was 4 times higher than the fraud attempt rate in the last week of April. However, it will be interesting to see if the number of friendly fraud cases increases over the next month, as shoppers short on cash may turn to false chargeback claims in order to make up for their losses. In fact, nationwide job and pay cuts have influenced customers to save, rather than shop. “Before, I’d spend as much as I had,” stated one Chinese consumer who recently lost their job.

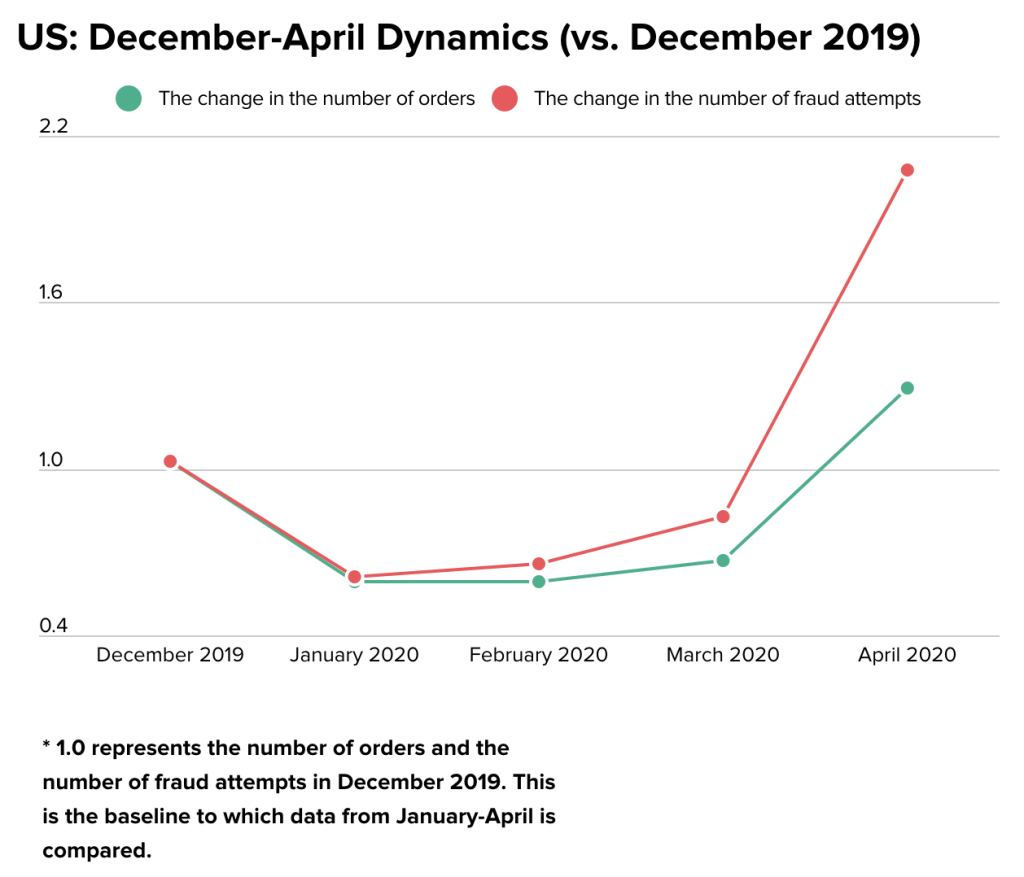

US

Despite consumer confidence dropping to a near three-year low in March, online sales jumped 25% amidst the crisis. The initial surge in online orders was driven by a need to stock up on cleaning supplies and groceries. But US consumers have continued to rely on eCommerce, beyond staple items. For example, in the first half of April, there was a whopping 777% spike in book purchases, followed by 182% rise in toys and games sales, and a 131% increase in the sales of sports and outdoors items. This shift to shopping for more than just basics could explain the sharp rise in sales in April, as the increase is evident in categories that are not staple.

In particular, April 16 saw the greatest volume of online orders since December. This was the day that Trump released the administration’s guidelines, titled “Opening Up America Again,” laying out a series of phases for how they could think about reopening. Although cases were up this day, Americans could’ve been feeling hopeful with the thought of an exit strategy in close sight. Not long after, a handful of U.S. states started easing economic restrictions. Meanwhile, fraudsters have been patiently waiting for businesses to let their guard down. The number of fraud attempts in April jumped up 45% from March. In particular, there has been a surge in cyberattacks, the FBI warning that Americans need to be alert to Coronavirus scams.

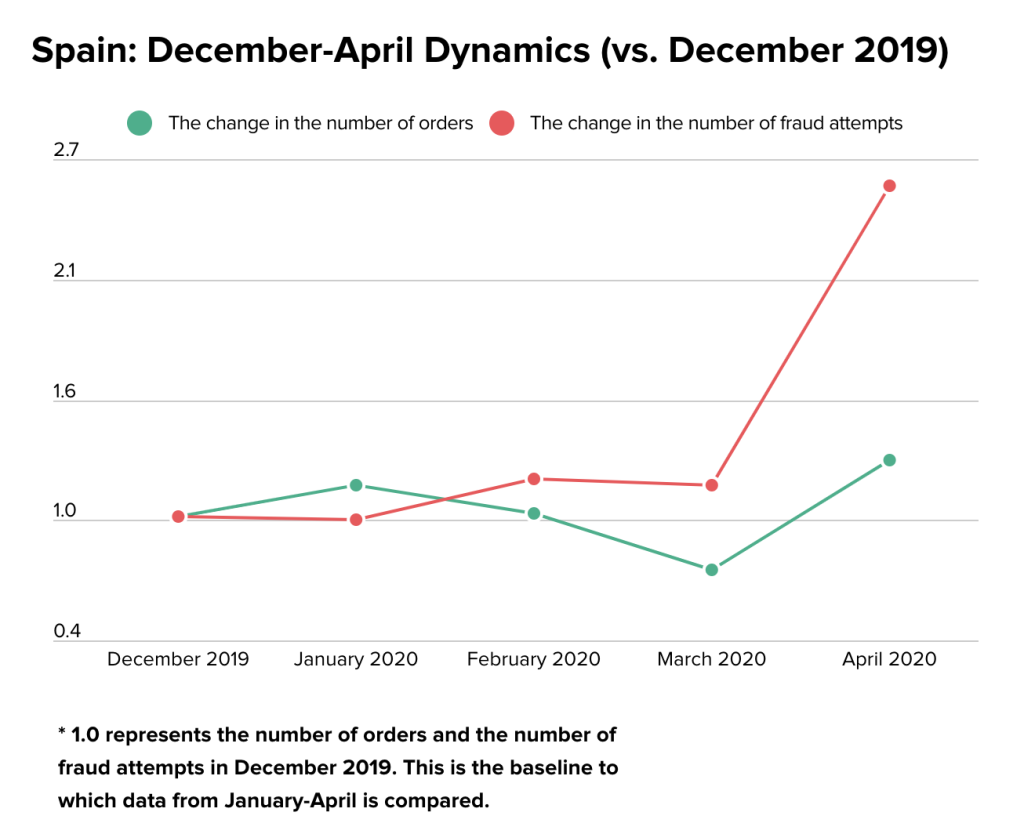

Spain

As consumers went into lockdown in March, some merchants like Spain’s El Corte Inglés saw big increases in online orders for electronics, home appliances, and toys. However, this trend wasn’t widespread as eCommerce sales plummeted that month. It wasn’t until April that consumers really turned to online shopping.

For example, over the past few weeks, Glovo, a Spanish food delivery service, saw grocery orders shoot up by 300%. Our own data revealed a drastic increase in April sales as well. Most noticeably, on April 26, the number of orders jumped 74% compared to the previous month. This was the same day that Spain reported its lowest daily death toll in more than five weeks, and children were allowed to go outside for the first time in six weeks. Fraudsters seemed to be celebrating in their own way, with double the number of fraud attempts on April 26 compared to the same day in March. This upsurge in fraud may be due to a rise in phishing scams. In the past few weeks, the number of these attacks in Spain has increased by 70%.

Latin America

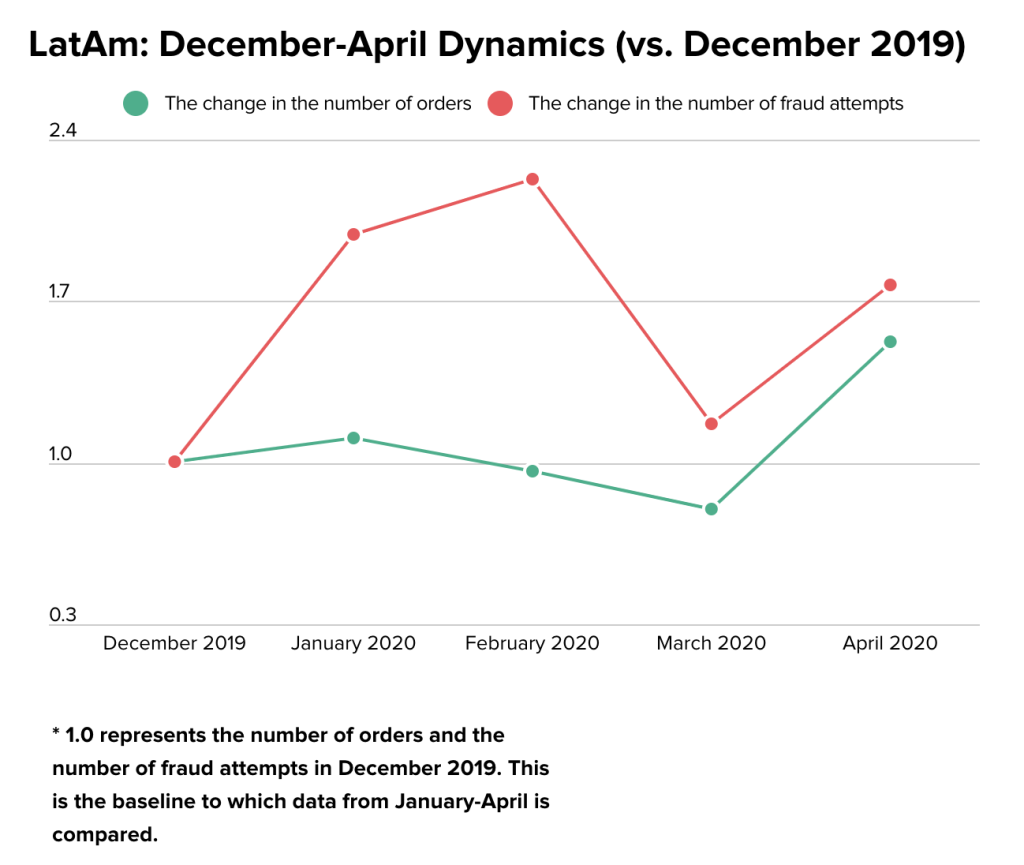

Although online sales slumped in March, certain online sellers like MercadoLibre, Latin America’s largest eCommerce company, saw a surge in demand as consumers rushed to buy necessities. Overall, during the month of March their platform saw 1.7 million new shoppers. As the outbreak continued, shoppers shifted to buying new essentials–items to help improve quarantine life. For instance, 59% of MercadoLibre’s new customers shopped in the sports and fitness categories. The increased demand for these stay-at-home essentials could explain the spike in online sales in April– averaging volumes that were 50% higher than December. The graph shows the shift in the number of orders and fraud attempts compared to December 2019 averages.

Riskified data shows a 64% order increase in April compared to March, topping off a nice recovery after figures fell in January, February and March. And it’s not just shoppers picking up their habits, but fraudsters as well. Fraud attempts rose in January and February but fell sharply in March. They rebounded and were up by 75% in April when compared to December figures. This may be due to fraudsters taking advantage of sales channels that are becoming more popular. For instance, downloads of delivery apps in Latin America shot up by more than 250,000 last month. And new customers on these apps may be especially vulnerable to ATO attacks.

UK

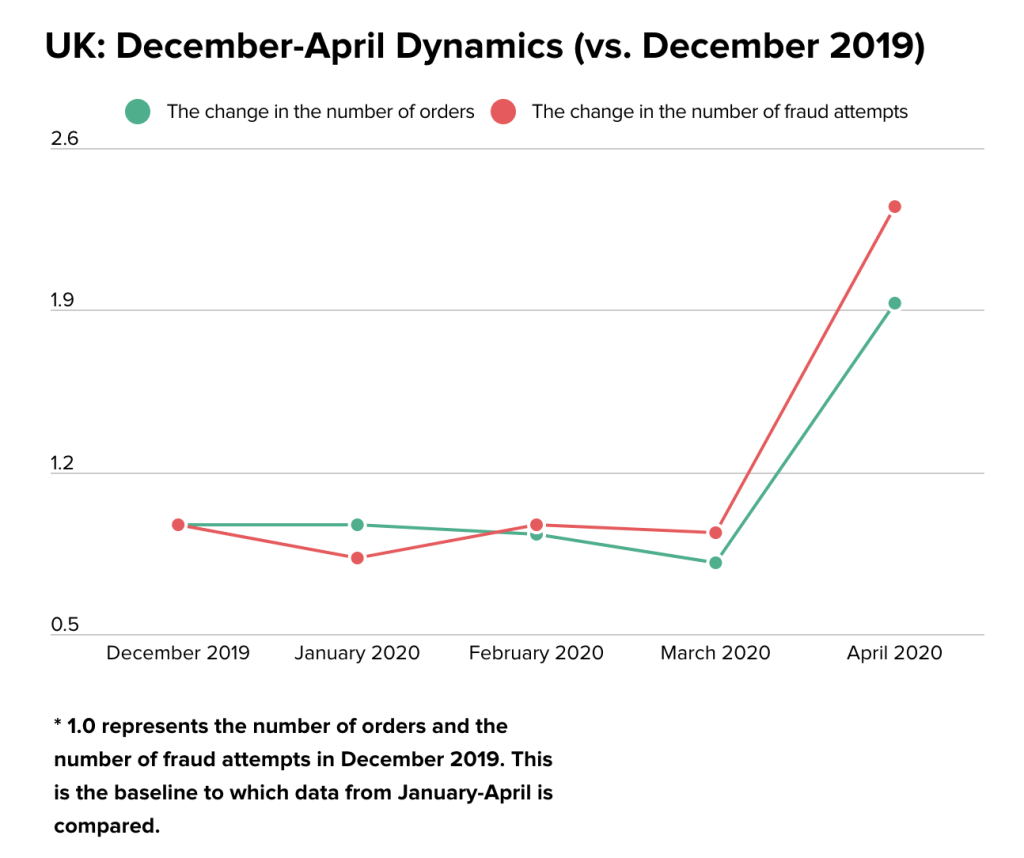

According to Riskified data, the number of online orders on March 19 was the lowest since December. However, following the announcement of the strict enforcement of the lockdown on March 23, sales did start to pick up.

From March 26 to April 26, sales jumped by 47%. Fraser McKevitt, the head of retail and consumer insight at Kantar, stated that by the end of April, online sales in the UK accounted for 10.2% of overall grocery, up from 7.4% in the previous month. So despite an overall slow down of sales in March, April proved to be a game-changer–especially for older generations. According to Kantar, the greatest increase was among the over-65 age group, who almost doubled the amount they spent on food deliveries. Meanwhile, fraudsters are acting quickly: the number of fraud attempts in April more than doubled over December figures.

Italy

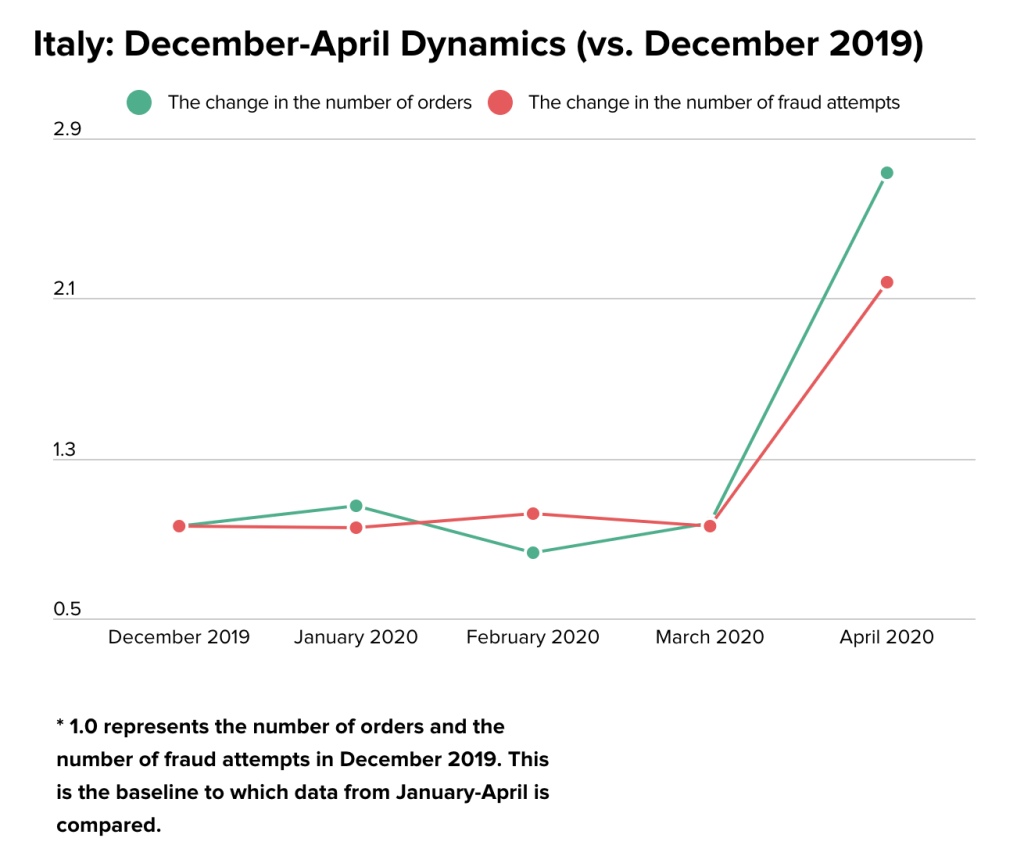

Italians seemed to have been ready to take on the digital opportunity to make the best of their situation. During the lockdown in March, there was a significant boom in eCommerce sales. Unlike in France, Spain, and the UK where sales had decreased. Our data shows that the number of sales in March rose by around 15% from February, and this upward trend continued through to April.

On April 20, the number of people infected with Coronavirus fell for the first time since the country’s outbreak began. The following day, the number of online orders was the highest since the beginning of December. The accelerated growth of eCommerce in Italy is likely to inspire more retailers and brands who hadn’t launched their online store or prioritized online operations, to do so now. Fraudsters are also taking advantage of the uptick– fraud attempts in April went up by 122% compared to December.

The bottom line

With April behind us, it’s evident that most eCommerce markets have adjusted to the new normal. Online sales were up and above December 2019 figures across all geographies, with the exception of China, where sales were slightly down in April, though still above December 2019 figures. While retail, in general, has taken a beating, we’re seeing more and more population segments making the adjustment and shifting to online sales– and the resounding message is clear. Scale has never been so critical for merchants, along with a malleable fraud operation that can adjust to changing shopper populations and behaviors. Although these events are temporary, the way merchants react now to the needs of shoppers will not only help boost sales in the short-term but protect brand reputation when this is all over. Reach out or read more about protecting revenue under COVID-19.