The Ticket to High-End Fashion Recovery

Through the pandemic, China has proven to be the most resilient and fastest growing market in high-end fashion. The primary driver of that growth is the Chinese luxury shopper who has shifted their spending to eCommerce in the local market now that travel restrictions prevent them from shopping high-end abroad. Furthermore, new research predicts that China will account for 50% of global luxury sales by 2030.

While European and American markets struggle to rebound from the pandemic, high-end merchants are trying to connect with Chinese consumers to accelerate their recovery efforts. Can these shoppers really be the ticket to making up lost revenue? Let’s look at why Chinese high-end fashion shoppers are so valuable and what merchants must do to gain favor with them sooner rather than later.

Why They’re So Valuable

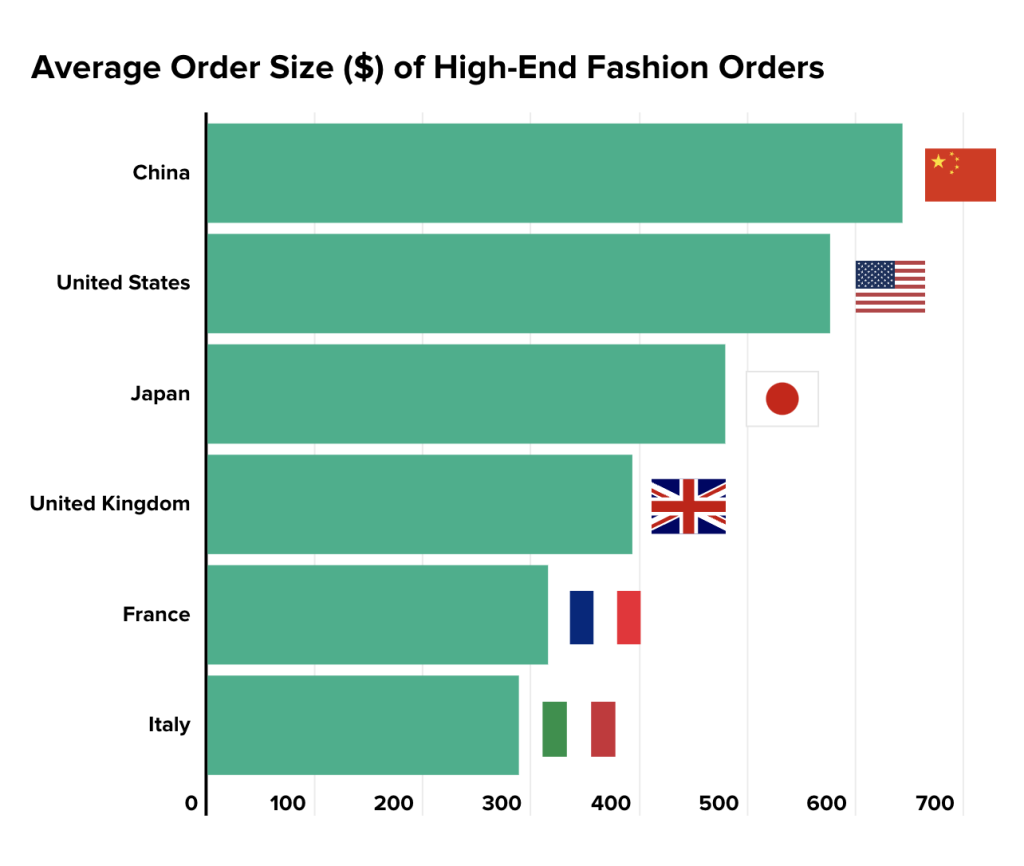

Chinese consumers are getting a lot of attention right now, and it’s well deserved. For one, they spend more per order than customers in other major markets. Chinese shoppers spend an average of $643 on high-end fashion per order while Americans spend $576, Japanese spend $479 and Britons spend $393. On top of that, Chinese consumers place a high-end fashion order more frequently than consumers in the United States, Japan and France, according to Riskified data. The revenue potential in China becomes that much greater since consumers of high-end fashion spend more, and more often.

One of the drivers for this trend is that Chinese consumers are younger and wealthier than their counterparts in other markets. Shenzhen, for example, is becoming one of the hot spots for luxury fashion in China. It has a population of 12 million people with an average age under 30. Additionally, Millennial and Gen-Z consumers account for nearly 60% of luxury sales in China. Gaining favor with these younger generations now can help major fashion labels create life-long customers.

Strategies for Expansion

Efforts to tap into the Chinese market with the same strategies that luxury brands use in Europe or the Americas will be futile. These customers are more digitally connected, which is why they’re making fashion purchases through social media apps like WeChat and Douyin (known as TikTok in the west). While high-end shoppers in areas like the US and UK place a high share of orders through mobile, the practice of leveraging social media hasn’t taken off in the same way as it has in China.

That explains why the Chairman and CEO of China’s largest online luxury retailer, Secoo, predicts eCommerce sales will make up 30% of China’s $150 billion annual luxury sales within the next five years, up from just 10% in 2020. It’s also why alternative payment methods are essential to this market. WeChat and AliPay are the main means of payment in China and the People’s Bank of China recently reported that mobile transactions grew 73.6% YoY. Alternative payment methods such as eWallets haven’t taken off in the US and Europe in the same way that they have in China, which makes fraud detection more difficult for high-end labels that rely on rules-based systems. Since Chinese consumers exhibit unique behavior, rigid fraud detection tools may over-decline good orders just because the payment type is unfamiliar.

Rules-based systems will also fall short on the issue of expedited shipping. According to Riskified data, over 88% of high-end fashion orders from Chinese consumers use expedited shipping, both because more merchants are offering it as a standard practice, but also because Chinese shoppers are willing to pay for fast delivery. This is important because the comparative risk of fraud in China for premium shipping is far less than in other markets. For example, in the UK, expedited shipping is 2x riskier than regular shipping, while in China, expedited shipping is 40% safer than regular shipping.

To win over Chinese shoppers, high-end fashion labels must have a strong presence on social channels, which includes setting up in-app stores and expanding live-streaming services. Brands such as Burberry, Prada and Bottega Veneta have all signed on to Tmall’s monthly luxury live-streaming promotion, which resulted in a 30% increase in YoY sales in June for Burberry. High-end fashion merchants must also expand their payment methods to fit the needs of Chinese purchasing preferences, especially with WeChat and AliPay. And finally, they must adapt their fraud detection methods to the behaviors of Chinese consumers. Expedited shipping and alternative payment methods are common practice and should not be automatically declined just because they are riskier in other countries. Implementing these strategies will help major fashion labels move closer to recovery while forging life-long relationships with high-value customers in China.