The True Cost of Declined Orders

To understand the full cost of declines, one must consider all the factors involved in a holistic risk management approach - which includes the sales and marketing investment that goes to waste when a good order is declined.

The Merchant Risk Council’s 2017 Global Fraud Survey showed that the average online store declined 2.6% of all incoming orders due to fear of fraud, including 3.1% of all orders worth over $100. For a $25 million business, this means rejecting orders worth more than $600,000 annually. But the true cost of declines is actually far higher than just the lost sales revenue.

To understand the full cost of declines, one must consider all the factors involved in a holistic risk management approach – which includes the sales and marketing investment that goes to waste when a good order is declined. Whether online media, SEM, or social media campaigns, eCommerce companies invest considerable funds and energy in customer acquisition and retention – bringing users to the website, bringing them to checkout, and trying to ensure they become repeat customers.

Expedia Inc, for example, invested $5.3 billion in marketing in 2017, equatable to more than 50% of the entire group’s annual revenue. If their decline rate was average, one could say 2.6% of that marketing budget, or ~$140 million was lost due to fear of fraud. Add the lost lifetime revenue from good customers whose order was wrongly rejected, and you start getting an idea of how costly declines can be.

In this post, we share our approach to calculating the true impact of declines on your business.

To fully understand the impact and cost of declines for your business, the following factors should be considered:

- Customer Acquisition Cost (CAC) –

What is the cost of bringing users to your site and converting them into customers?

- Customer Lifetime Value (LTV) –

How much revenue does the average customer generate for your company over time?

- Impact of Falsely Declined Orders –

What is the financial impact of false positive declines on your business? - Impact of Wrongly Blocked Orders –

What is the financial impact of blocking orders before they reach your fraud team?

There are plenty of useful resources out there on calculating the first 2 factors. To name a few, the Kissmetrics blog has a great post about eCommerce CAC, while Shopify, Hubspot, and Techburst all have useful posts about customer LTV. Therefore, while these factors are crucial to calculating the true impact of declines, I won’t go into detail about how to calculate CAC and LTV in this post, and rather, will focus on calculating the value of declined and blocked orders.

Calculating The Impact of Falsely Declined Orders

As mentioned earlier, on average, eCommerce stores decline 2.6% of all incoming orders. While some of these orders are indeed fraudulent, declined orders are often viewed more as cost avoidance than lost revenue.

While most merchants estimate 10% or less of the orders they declined should have been approved, our experience has proven that between 30%-70% of all orders typically declined by merchants are false positive declines (aka legitimate transactions). This is because most fraud systems and tools are very biased towards being risk-averse. Any data point that may indicate risk is flagged, and risk management teams must have the mindset of actively striving to approve orders despite mismatches in order to avoid false positive declines.

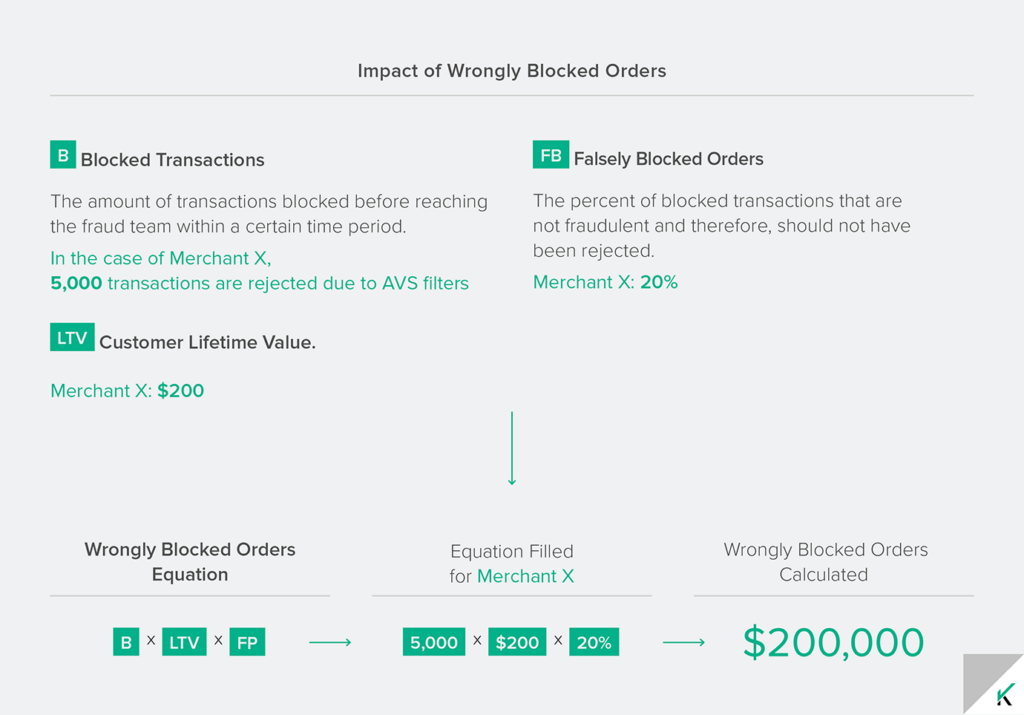

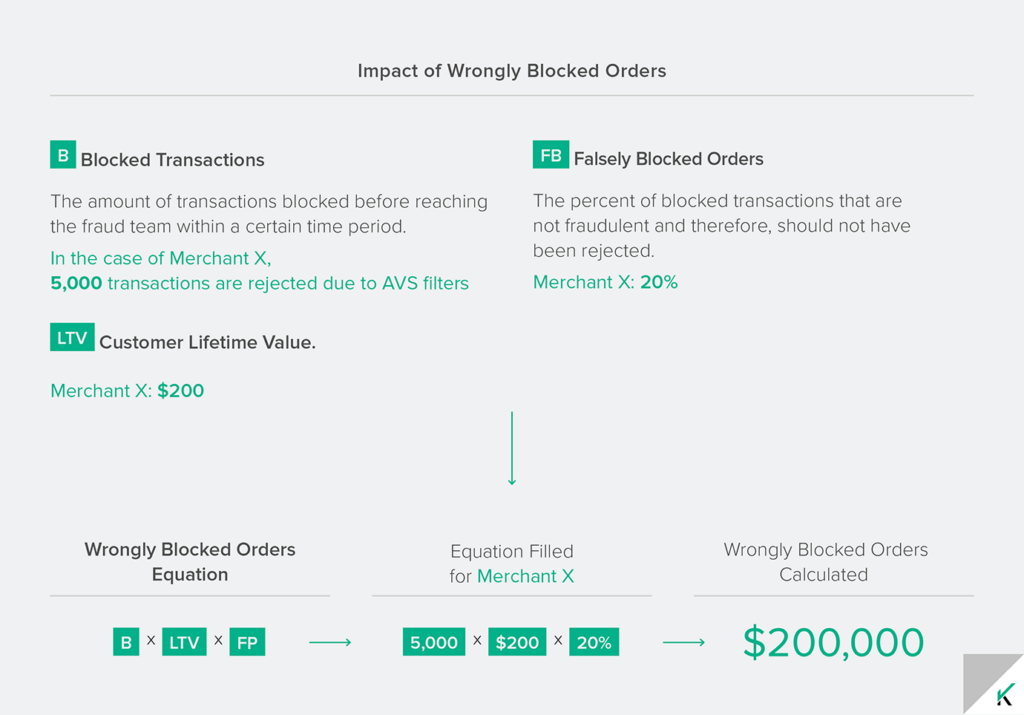

On top of the value of the orders that are falsely declined, one should consider the potential lifetime value that is lost when a legitimate customer’s order is wrongly declined, as well as the wasted cost invested in acquiring a good customer whose order is then rejected. In other words, to calculate the financial impact of falsely declined orders, the value of orders that were wrongly declined, the lost customer lifetime value, and the wasted customer acquisition costs should all be taken into account.

Below are equations for calculating the financial impact of false positive declines. We’ve filled out the equations using the stats of Merchant X, an average online fashion retailer based in the United States.

Calculating The Impact of Wrongly Blocked Orders

It is often the case that some transactions are rejected or filtered out before even reaching the fraud team. For instance, many merchants deploy systems that block orders from “risky” geographic locations, because they feel accepting orders from these locations is not worth the risk. The decision to reject all orders placed from certain countries is sometimes based on bad experience – after a significant sum is lost to chargebacks, for example. But Riskified research has found that even orders from the riskiest countries are still mostly safe, and simply blocking these orders is sure to leave money on the table.

Another common reason for rejecting orders on the gateway level is AVS (Address Verification System). Payment processors encourage merchants to set automatic AVS mismatch filters as an anti-fraud measure. Online fashion boutique RSVP Gallery, for example, used AVS filters before moving to Riskified. However, 20% of the orders Riskified approves for this merchants on a regular basis would have been rejected by their AVS filters. (read our blog post to learn more)

3-D Secure is yet another service that can lead merchants to inadvertently reject orders from legitimate customers. While this payer authentication service doesn’t block orders per se, it adds additional verification steps to the checkout process, impacting not only customer experience but also sales conversion rates. In other words, utilizing 3D Secure effectively results in a high drop-off rate, preventing many legitimate orders from even making it through to the risk management team. An update to this process – 3-D Secure 2.0 – is currently being rolled out, but even this solution relies on friction heavy measures that require shoppers to verify their identities using cell phones and tokens.

To sum up, in addition to the value of the orders that are falsely rejected before reaching your fraud team, one should consider the potential lifetime value that is lost when a legitimate customer’s order is wrongly blocked.

The following equation can be used to calculate the financial impact of legitimate, blocked orders:

Correctly calculating the financial impact of wrongly blocked orders can be tricky. First of all, merchants do not always have the required data. Many online stores don’t know how many incoming transactions are blocked by rules or filters such as those mentioned above. If you don’t know all the metrics, we recommend asking your payment processor for these numbers.

Secondly, it is not necessarily accurate to use the same customer LTV for blocked orders. Riskified’s data shows that cross-border orders are actually worth far more than those placed domestically: for instance orders placed with cards issued in Latin America or the Middle East in the US are worth 41% more than those placed with domestic US cards. If you are rejecting international orders or orders placed with cards that don’t support AVS (anywhere outside the US, UK and Canada), you are likely turning away some very high value customers.

Lastly, calculating the true rate of falsely blocked orders is very hard. The insult rate, or number of customers who contact you complaining over a rejected order, is much smaller than the actual amount of good customers you’re turning away.

The End of Declines Starts Today

The financial impact of blocking and declining transactions is largely underestimated by eCommerce merchants. Reducing the amount of legitimate orders that are rejected can have a significant impact on the company’s overall performance. In our experience, removing filters and reducing false positives leads to significant increase in merchants’ sales revenue. Therefore, taking the time to calculate the impact of declines on your business and working to reduce false positives is well worth the effort.

Author’s Note: This post was originally published in Feb 2015, and has been updated to reflect current data.