Streamline chargeback management, recover revenue

Streamline chargeback management, recover revenue

Simplify your chargeback operations with a single smart platform

Join global category leaders unleashing their ecommerce growth with us

See our customersManage all of your chargebacks in one place

Siloed systems can make a mess of your chargeback operations. Riskified automatically collects all your chargebacks so you can view and act on them in one platform. Think of it as your chargeback OS.

Reduce the time and effort spent disputing chargebacks

It takes an analyst 20-30 minutes to compile the evidence for a single chargeback. Automate evidence creation and submission to scale revenue recovery without added effort.

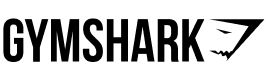

Retain as much control as you want

Automation is key to unlocking efficiency and scale, but in some cases, you may want to add your unique evidence. With Riskified’s robust built-in editor, you can edit your evidence packet, attach files, and submit with just a click.

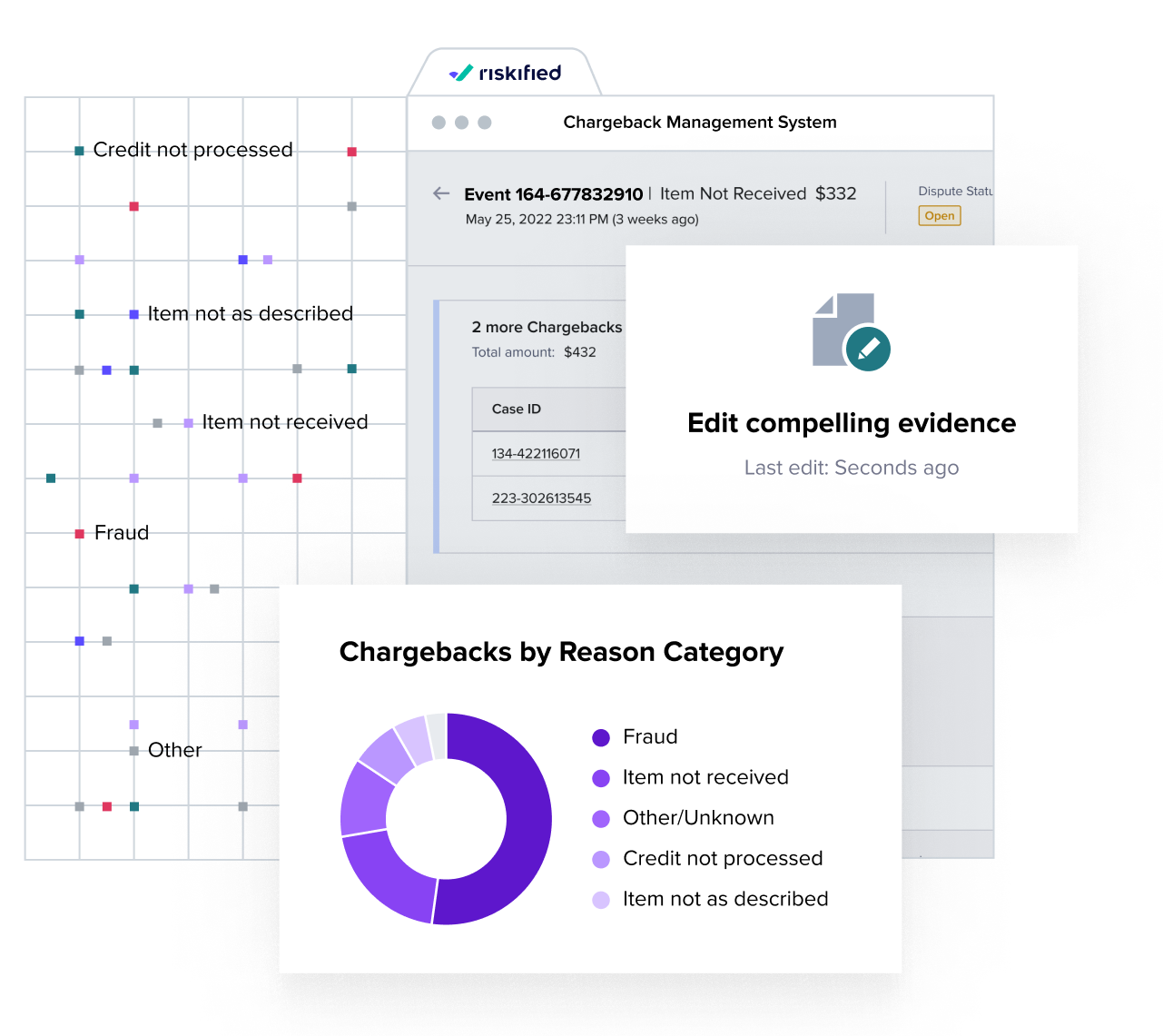

Track key chargeback metrics

Get a handle on your chargeback and dispute performance with advanced dashboards. Easily filter and segment based on the dimensions that make sense for you.

Download the solution overviewProtect your bottom line from chargeback abuse

Leverage robust data

With Riskified integrated into your checkout flow, we collect and enrich contextual data about every single order. If it comes back as a chargeback, that data is leveraged to compile the best evidence and boost your chances of success.

Tailored to your needs

Your chargeback workflow differs depending on what, where, and how you sell. Our solution can automate as much or as little as you desire, allowing you to maximize efficiency while retaining as much control as you need.

Plug and play

Riskified integrates directly with your gateway to fetch chargebacks and disputes in real-time. It’s easy for merchants to integrate securely and enjoy end-to-end automation, while never missing a chargeback deadline again.

Fill in the form to get our Dispute Resolve Solution Overview

Request a personal demo

Speak to a product expert about how you can streamline chargeback operations and recover revenue from abusive chargeback claims.

Request demo