Going the Extra Mile

Tackling the challenges of cross-border expansion

By Mirit ElyahuJuly 2022

Submit the form to continue reading

Going the Extra Mile

Many merchants hold back from geo expansion due to a lack of familiarity with new customers, local shopping habits, foreign currencies, payment logistics, or local customer expectations.

Unfortunately, some merchants that implement anti-fraud measures and payment restrictions find that legacy systems and technologies cause them to reject orders attempted by new customers––or block them altogether––which discourages global shoppers from visiting their sites.

This eBook explains the four fraud-related challenges of international expansion and highlights what merchants should know to mitigate risk while leveraging the opportunity for successful expansion.

Mastering a new market, exceeding expectations

The risk and reward of new customers

Payments as the keystone of any global expansion strategy

Regional instability, or, don’t put all your eggs in one market

Key takeaways

Prioritize an international expansion strategy

The industry’s pandemic-induced boom pushed consumers to become more comfortable with online shopping options while increasing their appetite for cross-border shopping.

Understand the shopping behaviors of international customers

Local customer behaviors vary based on economic ecosystems, geopolitics, and local cultures––often requiring prompt adjustments to fraud prevention measures.

Ensure that fraud protection doesn’t cause friction

Consumers expect localized and seamless experiences throughout the shopping and payment journey, regardless of their shopping or shipping location.

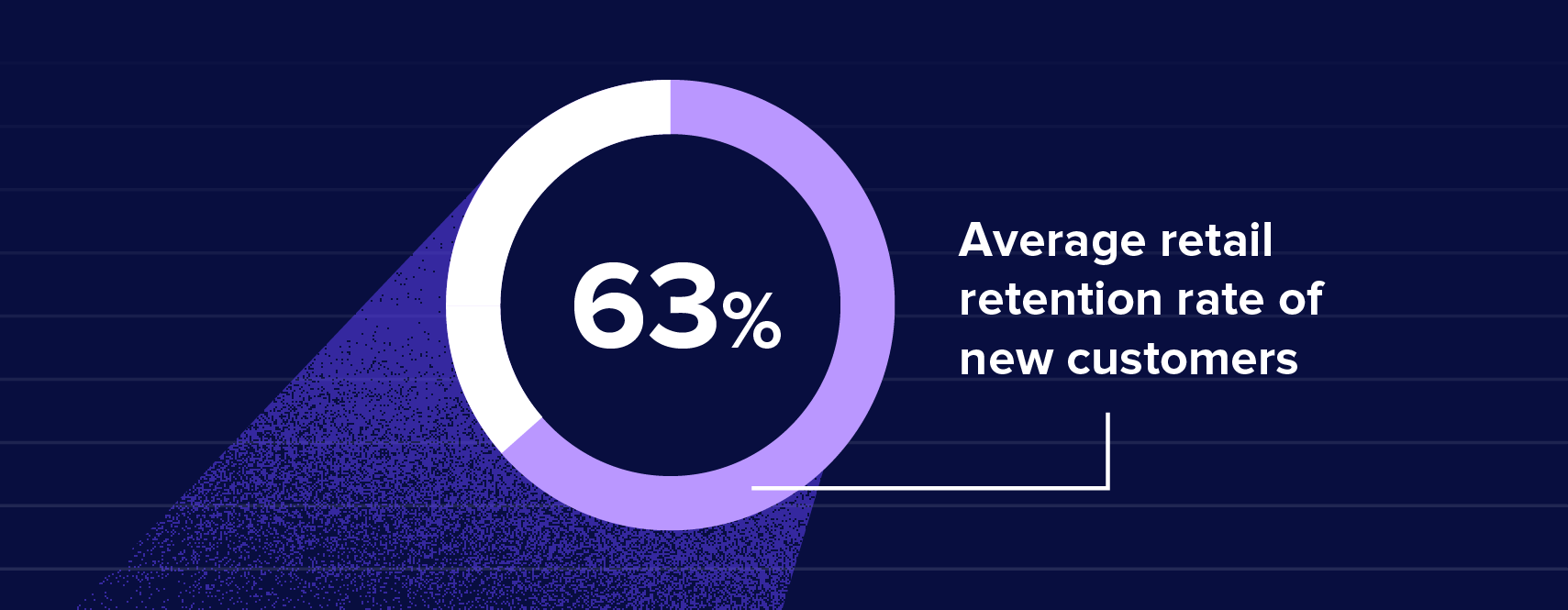

First-Time Customers, CLV, and the False Decline Problem

Essential information payments executives need to know

First-time customers, CLV, and the false decline problem